The United Nations’ Global Crisis Response Group on Food, Energy, and Finance, is reporting that across the world, most workers are earning less proportionally than before the pandemic, more countries are facing debt distress, and acute hunger and famine conditions are affecting hundreds of millions more people. Russia’s illegal invasion of Ukraine has exacerbated an unprecedented global cost-of-living crisis, by disrupting supplies of food and energy.

It is in this context that Bloomberg reports that Emmanuel Macron, the President of France, is under intensifying political pressure to tax windfall energy profits and provide purchasing power enhancement payments to households. That pressure is coming from both the right and left of the French political spectrum, both of which accuse oil and gas companies of war profiteering.

Though some economists worry windfall profit taxes could encourage oil and gas providers to raise prices, others say this concern ignores a basic flaw in the pandemic-conflict-scarcity equation. What is being called “inflation” is in fact the result of a decision by oil exporting countries to rig markets to drive prices higher and pressure western democracies, exacerbated by the illegal invasion of Ukraine.

Leading mainstream economists note the windfall profits do not reflect anything companies did to increase efficiency, provide better value, or earn higher revenues; they are simply the result of higher prices. Because those higher prices result from distortionary (even lawless) behavior, not acting to curb windfall profits only encourages more distortionary behavior, and will lead to a slower recovery with more real-world harm to those who can least afford it.

Rising prices for energy and food are shrinking real income and could undermine local economies and overall economic activity.

The question facing President Macron is whether he can, in fact, impose a windfall profits tax and restore purchasing power to households at the same time. This is both a political question and a mathematical one:

- politically, there is support from left, right, and center;

- the mathematics will have to do with decisions about the long-term direction of energy systems and mainstream financial incentives—can both the tax and the purchasing power protection serve as longer-term investments in national resilience and inclusive prosperity?

This suggests a climate income system could be the solution for the people of France, and for Mr. Macron’s effort to address the cost-of-living crisis.

- A climate income system could start with an upstream fee on fuels that generate global heating emissions, at the level appropriate to correct for war-related windfall profits.

- The revenue from those fees could then be returned to households as monthly checks or direct deposits, with the aim of filling the need for enhanced purchasing power.

- The fee could be structured to increase steadily over time, to provide a predictable and directional signal to those who buy, sell, and trade the affected fuels; over time, these fuels will become less profitable.

- Household payments would then also increase, ensuring the energy transition enhances purchasing power for households and creates a durable foundation for inclusive prosperity.

A statement of support for climate income—sometimes called “carbon fee and dividend” or “carbon dividends”—was signed by more than 3,000 economists, including 28 Nobel Laureates, 4 former Chairs of the Federal Reserve, and 15 former Chairs of the Council of Economic Advisors.

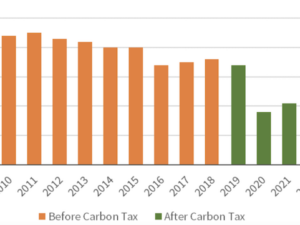

Canada already has a climate income system as its federal backstop plan to establish a national floor price and support an orderly transition away from global heating emissions. The Climate Action Incentive payments deliver as much as $1,100 to Canadians in some provinces, with “approximately 90 per cent of direct proceeds from carbon pollution pricing are returned to residents”. The remaining revenues are used to provide support to farmers, small businesses, Indigenous groups, schools, universities, and municipalities.

Austria will be implementing its own climate income policy, and is increasing the “climate bonus” payments, to help restore purchasing power. By activating climate income as an inclusive transition strategy, France could help to ensure Europe does not backslide on its climate commitments and galvanize G7 efforts to establish a cooperative Climate Club.

Emmanuel Macron has consistently sought to make France a leader on climate-smart transformation, including his convening of the One Planet Summit in 2017 and the ongoing series of solutions-focused meetings.

A strong climate income system can serve as a strong, clear standard for a carbon border adjustment mechanism, incentivizing trading partners to follow suit. With climate income as a national policy, President Macron would position France to more forcefully resist the supply shock blackmail being threatened by Vladimir Putin as a way to extort concessions from lawful nations.

The long-term fiscal stability of nations depends both on keeping the everyday economy vibrant and on making smart choices about structural incentives, so everyday investments don’t generate pervasive preventable damage. Climate income can meet France’s needs now, and provide the most stable foundation for fiscal and economic health going forward.

Additional resources

- What is Climate Income?

- Prime Minister Trudeau’s call for leaders to enact and defend pollution pricing

- Canada: Climate Action Incentive Payments for 2022-23

- People-centered carbon pricing is a short-cut to a better future

- Climate income can expand “non-market” approaches to international cooperation under the Paris Agreement

- Climate income as an energy independence measure

- Bipartisan carbon fee and dividend legislation in the US Congress