The CCI Resilience Intelligence Program is focused on substantive support for the Resilience Intel climate-smart finance initiative. Resilience Intel emerged from the Acceleration Dialogues, as a technical response to the needs of key decision-makers, including Ministers of Finance and private-sector financial actors.

The key need cited was to improve the integration of Earth systems science insights into financial data systems. How this is done makes a difference in how financial decision-makers can deploy science insights in their everyday activities.

- If science insights come primarily from highly technical scientific reports or from advocacy organizations, it is harder to understand the finance-specific costs and benefits.

- If science insights come exclusively from ESG reports, which lay out vital and useful information, but only a few times a year, that allows a lot of conventional financial thinking to hold sway over day to day decision-making.

- And yet, if financial decision-makers ignore the red alert signal being sent by scientific review of our worsening climate emergency, they will dramatically undermine their chances of future success.

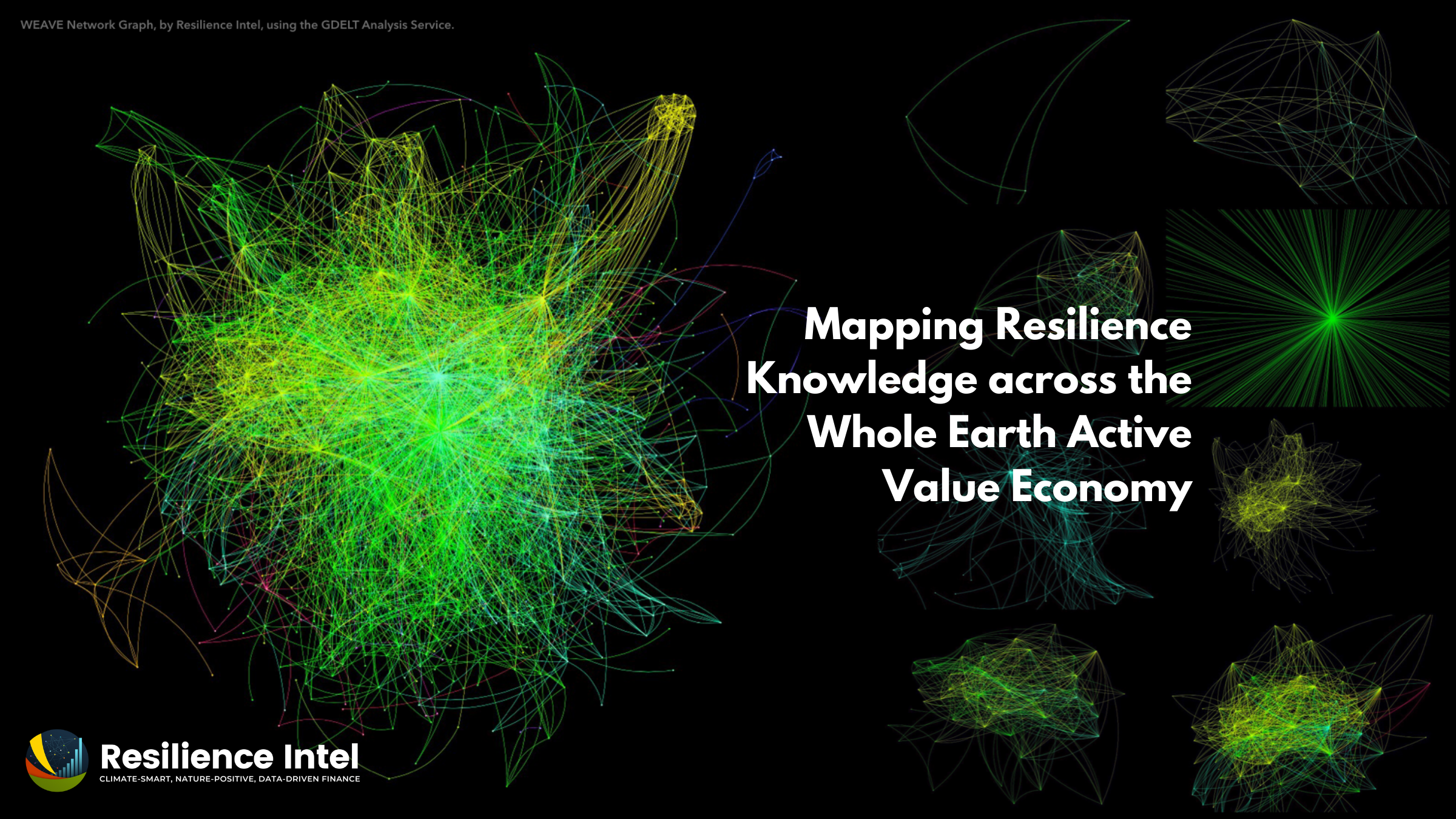

Resilience Intel was created to map critical integrations of data relating to macrocritical drivers—those economy-shaping non-monetary forces that undermine or expand the potential for future value creation. The Resilience Intel Charter recognizes that:

The best possible human future is one in which climate-smart decision-making ensures we invest in the larger-than-market planetary systems that make all that we value (in numbers and otherwise) possible.

A central goal is to integrate data systems so that science insights can weigh on financial data in a more day to day way, nudging decision-makers toward more climate-smart resilience-building choices. Such an integrative Resilience Value metric would:

- Integrate multiple disparate areas of concern;

- Learn, evolve, and adapt to new strategies and information flows;

- Translate overall assessments of value creation and climate progress into directional insights (doing better vs. doing worse / adding value vs. depleting value).

It would also need to integrate across:

- Micro-scale operational mitigation of carbon emissions;

- Reduction of Scope 3 / supply chain emissions;

- Overall mitigation of global emissions (OMGE);

- Alignment with science-based targets for 1.5ºC net-zero pathways;

- Micro-scale climate impact management and adaptation benefits;

- Wider (external) adaptation benefits;

- Building vs. depleting the health and resilience of natural systems;

- Progress across the 17 Sustainable Development Goals;

- The inclusive expansion of economic opportunity and the building of human capital (including health and resilience) in low-income, marginal, and front-line communities;

- Strategic innovation value—the degree to which an investment helps to transition the wider economy away from dangerous climate disruption toward livable climate resilience.

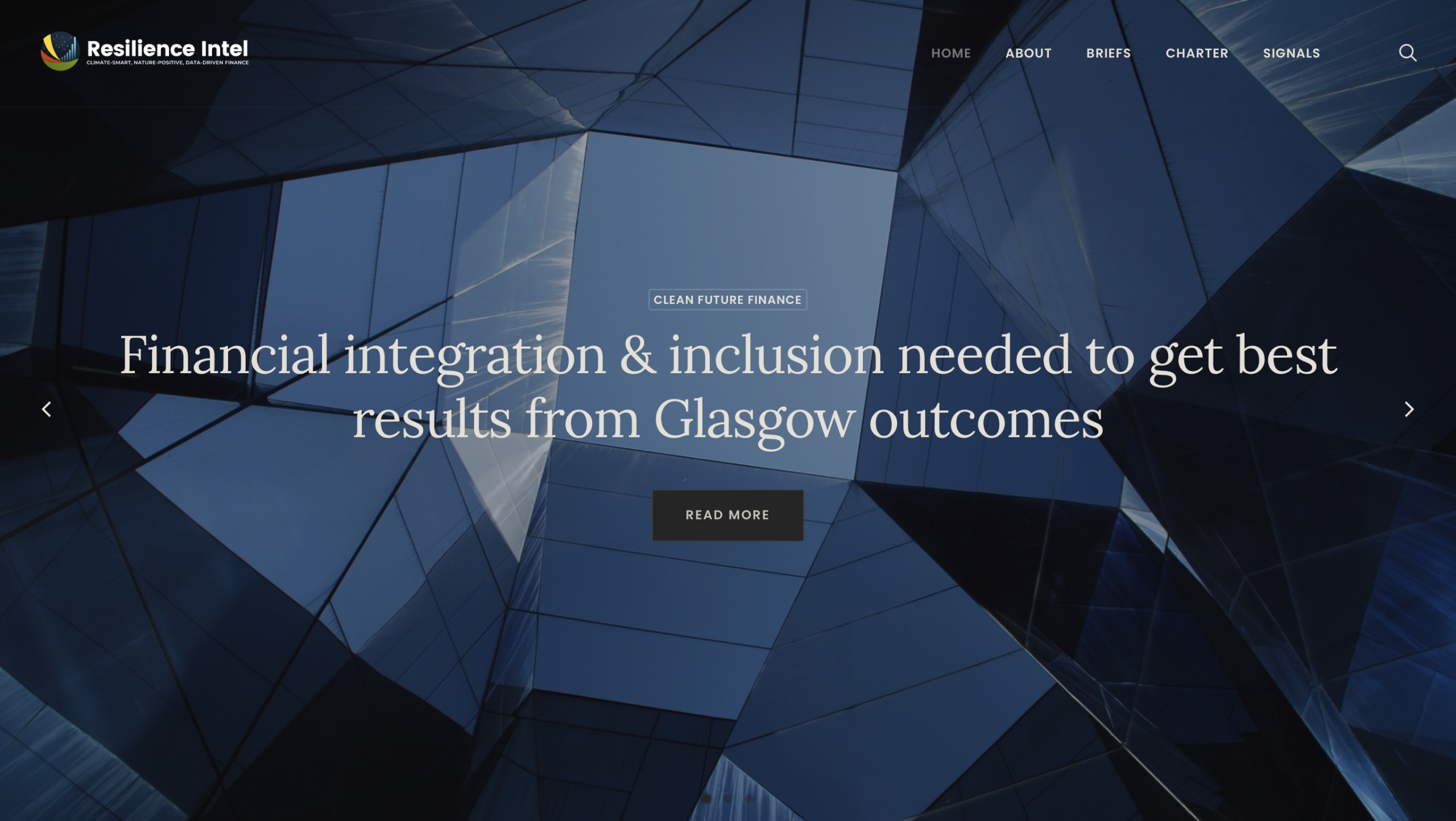

We lay out the broader implications for inclusive climate finance and multi-sector investment in sustainable development in a December 2021 brief, “Financial integration & inclusion needed to get best results from Glasgow outcomes”.

Finance must be inclusive to succeed on climate

After the Glasgow climate talks consolidated important procedural breakthroughs and secured the commitment of 450 institutions to align $130 trillion with science-based net zero goals, we highlighted ways for integrative and inclusive finance to drive climate action, at speed.

Capital to Communities—The 2022 Reinventing Prosperity Report

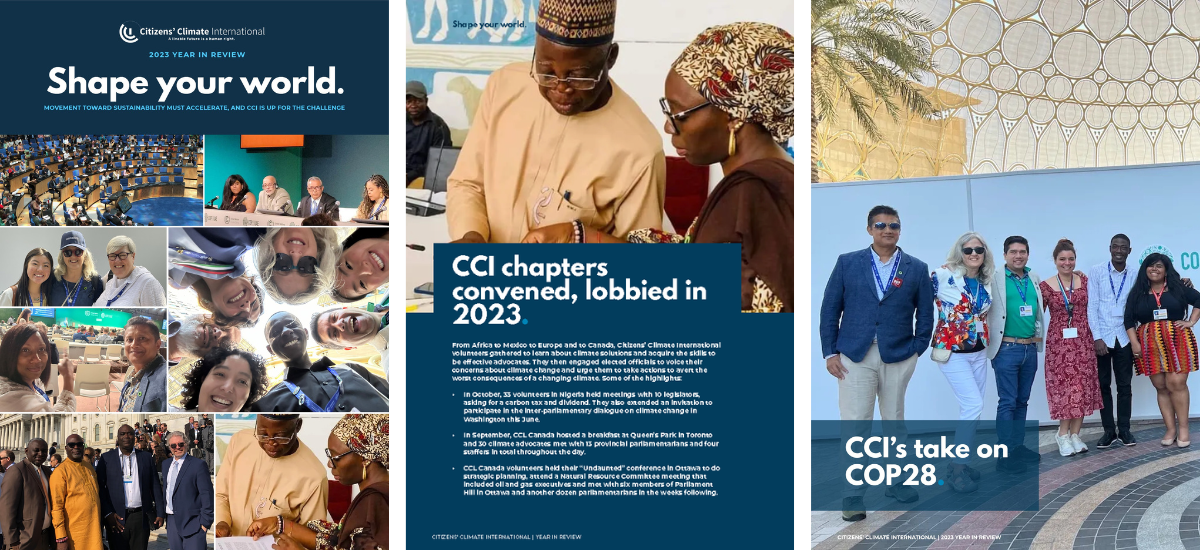

In 2020, as the COVID-19 pandemic disrupted lives and livelihoods across the world, CCI volunteers, coordinators, and staff met weekly to consult on conditions and establish principles for investing in recovery that would improve conditions for the most vulnerable. Read our 2022 report.

Ocean-smart: Invest at the Source

The outcome report from an Acceleration Dialogues event at the 2019 Monaco Ocean Week, “Invest at the Source” focuses on the resilience-building value of making better choices upstream to support success against critical goals for ocean health and resilience.