What are Laser Talks?

Just as a laser is powerful and focused, a Laser Talk is a brief but powerful statement on a specific topic. Reading our Laser Talks is a great way to get informed about Citizens’ Climate Internaational, climate policy, and related scientific, economic, and political issues.

The principal audience for our Laser Talks are volunteers who meet with legislators and their aides, but we also expect them to be educational for other stakeholders and the general public. Laser Talks are not meant to be memorized, but to provide understanding that will help you respond, in your own words, to questions you may be asked.

Learn to speak like a climate pro

Practice our laser talks:

Learn to speak about climate change like an expert.

PAIR AND SHARE: Practice the laser talks with a partner over coffee.

MIRROR WORK: Rehearse them in front of a mirror.

PICK AND CHOOSE: Practice the laser talks that interest you the most – you don’t have to learn all of them. If you are new to Citizens’ Climate International learn the carbon pricing ones first and try to internalize two to three laser talks a month. By six months time you will have absorbed the key laser talks.

Note that the laser talks are not meant for people to present as monologues. The real purpose of the laser talks is to facilitate a discussion on climate change with our political representatives, the media, and the public.

Carbon Pricing Laser Talks

What is carbon pricing?

Carbon pricing refers to policies that make it more expensive to pollute—ideally making polluters pay more to do business in such a way, without creating economic difficulties for everyone else.

A carbon price, or price for pollution, can be applied at various points, as fuel moves through the economy:

- upstream (on the raw material—coal, oil, or gas);

- midstream (on refined and processed fuels and other products);

- downstream (where fuels generate emissions).

Applying the price upstream is the most direct way to ensure the cost of polluting is paid by those doing business with polluting fuels. They may “pass through” that cost to other businesses and to consumers. To avoid pass through costs falling on households, small businesses, and community economies, revenues from a carbon tax can be returned to those affected, or to everyone.

Carbon pricing policy options include:

- Carbon tax—a direct tax on pollution, which can be upstream, midstream, or downstream.

- Climate income—a carbon fee paid as far upstream as possible, with all revenues returned to households in regular checks or bank deposits.

- Emissions trading—usually including a limit on the overall amount of pollution, with polluting businesses allowed to trade pollution permits, to facilitate their transition to clean energy systems. An emissions trading system, or ETS, is usually assessed midstream—on power companies, for instance.

- Border adjustment—a carbon price assessed at the border, to ensure goods and services originating in countries that don’t price pollution aren’t artificially cheaper than goods and services that pay the costs of pollution.

There are variations on each of these, and it is possible to have a carbon price that uses more than one of these options. It is also possible to use regulations to impose costs without a direct carbon price; this is less economically efficient and tends to mean pass-through costs are higher. In the absence of carbon pricing policy, we still pay for pollution; a study published in June 2022 found that inaction to curb climate change would cost the world $178 trillion over the next 50 years.

It is worth noting: a carbon tax is different from a fuel tax or gas tax. A fuel tax is often used to create a pool of public funds that can help to sustain infrastructure related to the vehicles using the fuel. Revenues may be devoted to maintaining highways, or subsidizing mass transit to reduce congestion. A critical difference is that a fuel tax is not intended to phase out the use of that fuel, whereas a carbon tax aims to reduce overall use of the fuel and eventually to phase it out entirely.

Because climate change is imposing devastating costs on people, economies, and nations, it will be increasingly important to enact policies that make polluters pay the full costs of their business activity. Nations can work together in bilateral or multilateral cooperative arrangements to participate in shared emissions trading systems or to align carbon taxes and other policies, to increase the economic efficiency of their energy transitions.

===========================================================================

Carbon Pricing Around the world

==========================================================================

Carbon Fee and Dividend a.k.a. Climate Income

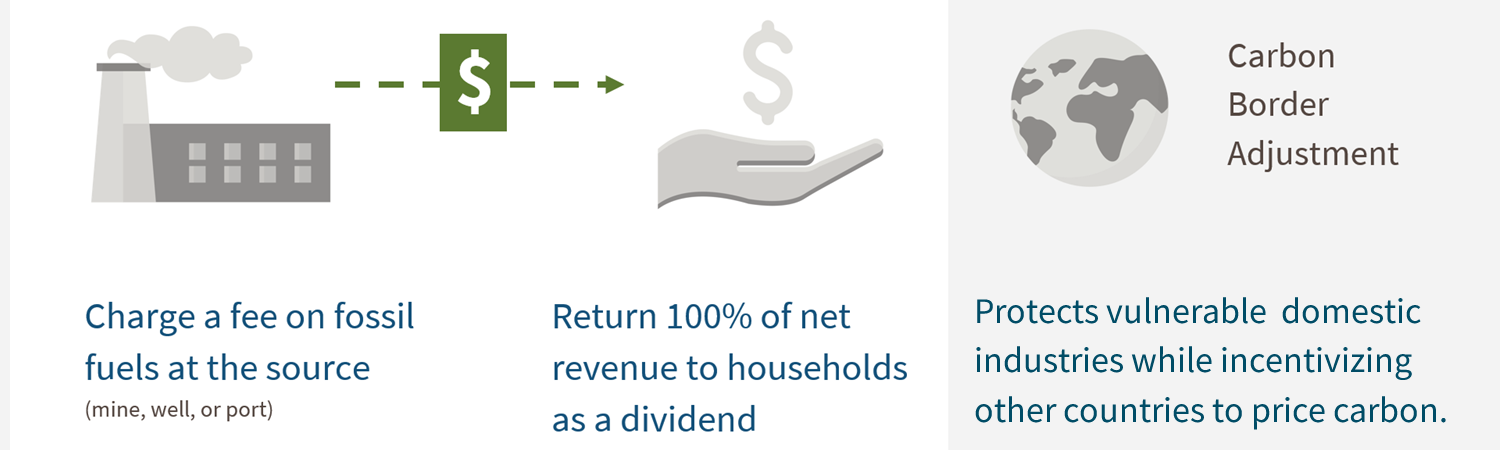

Carbon Fee and Dividend is a carbon price that is revenue-neutral (meaning that the revenues do not go to government coffers). It is also known as Climate Income. It functions as follows:

- A fee is placed on carbon-based fuels at the source (well, mine, or port of entry).

- This fee increases steadily each year so that clean energy is cheaper than fossil fuels within a decade.

- All the money collected is returned to Canadians on an equitable basis.

- Under this plan, most Canadian households would break even or receive more in their dividend than they would pay for the increased cost of energy, thereby protecting the poor and middle class.

- A predictably increasing carbon price will send a clear market signal, which will unleash entrepreneurs and investors in the new clean-energy economy.

- Border carbon adjustments are eventually enacted in partnership with climate-friendly nations to protect vulnerable domestic industries while incentivizing other countries to price carbon.

========================================================================

Carbon Border Adjustment Mechanisms (CBAM)

Our Carbon Fee and Dividend policy has a provision built in to protect trade competitiveness: a “Carbon Border Adjustment Mechanism” (CBAM) imposed on carbon-intensive trade-exposed goods that cross our border in either direction. Products imported from a country that does not bear a carbon price equivalent to ours will have to pay a surcharge to make up the difference. Conversely, a domestic-made product exported to such a country will get a refund for the carbon fee associated with its carbon footprint.

This CBAM prevents domestic manufacturers from being put at a competitive disadvantage in global markets because of the fee. It will also remove the incentive for them to relocate overseas to avoid the carbon fee. In addition, it will encourage foreign countries to adopt their own carbon fee, so they would get the money instead of us. Carbon Fee and Dividend’s CBAM is designed to comply with international trade law.

Note that the CBAM applies only to carbon-intensive products, not fuels. As well, considerations of common but differentiated responsibilites must be at the core of all CBAM design and intrinsic carbon pricing.

===============================================================================

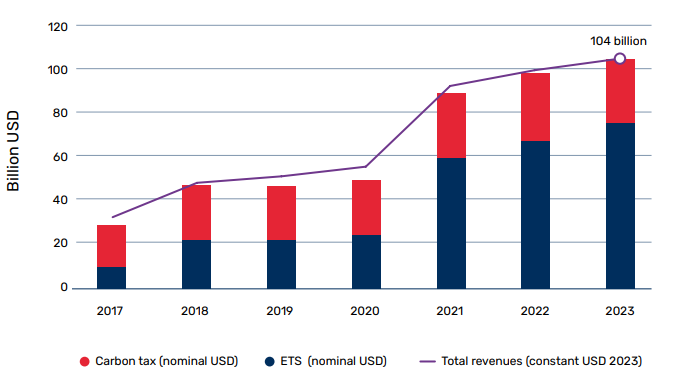

Carbon Pricing Around the World

IMAGE SOURCE: World Bank’s Carbon Pricing Dashb

Around the world, carbon pricing initiatives are driving emission reductions that cause climate change. Using data from 142 countries over two decades, researchers found that the average annual growth rate of CO2 emissions from fuel combustion in countries with a carbon price to be 2 percentage points lower compared to countries without a carbon price (Carbon Pricing Efficacy: Cross-Country Evidence, 2020). Further, an additional euro per tonne of CO2 is associated with a reduction in the subsequent annual emissions growth rate of approximately 0.3 percentage points, all else equal.

Carbon pricing initiatives have been implemented or scheduled for implementation in 89 jurisdictions. This includes 50 national initiatives and 39 subnational initiatives. In 2024, these initiatives cover 12.8 GtCO2e, representing 24 % of global GHG emissions. However, only 1% of global emissions currently covered by a carbon price are within the price range needed by 2030. Prices must rise considerably to meet the Paris Agreement temperature goal of 1.5 degrees.

For the most up-to-date information, visit the World Bank’s Carbon Pricing Dashboard.

Important initiatives that will drive global carbon pricing:

- The World Bank, and several country launched the Partnership for Market Implementation which will assist countries in the Global South in either improving their current carbon pricing or implementing carbon pricing at COP 26 in Glasgow .

- On June 6, 2022, Canada and Chile, two countries that have implemented a carbon tax, issued an agreement to accelerate the adoption of carbon pricing around the world.

- On May 16, 2022, Canada and the EU issued a joint declaration confirming the willingness of the EU and Canada to coordinate on respective approaches to carbon pricing and carbon border adjustments to prevent carbon leakage. They also confirmed the intention of the EU and Canada to work together to engage international partners to expand the global coverage of carbon pricing.

- The European Union enacted border carbon adjustments by January 2023 to go into effect in 2026.

- The following was stated in the 2024 World Bank’s States and Trends of Carbon Pricing report:

“CBAM payments will be required from 2026, which has spurred governments to consider implementing carbon pricing to reduce potential CBAM costs. Countries including India, Indonesia, Morocco, Türkiye, Ukraine, Uruguay, and Western Balkan countries, have implemented, adjusted, or are considering implementing direct carbon pricing to reduce CBAM compliance costs and to capture revenue that would otherwise be paid to the EU.”In short, the EU is acting as a leader on carbon pricing, and moving other countries to follow suit thanks to CBAM. Looks like hitting the wallet is what makes things move forward!

Canada’s Greenhouse Gas Pollution Pricing Act

In June 2018, the Greenhouse Gas Pollution Pricing Act achieved Royal Assent and became law of the land in Canada. Under the regulation, all provinces and territories must have had a carbon pricing policy of at least $20 per tonne by April 1, 2019, raising $10 per tonne each year until 2022, with the flexibility to have their own carbon pricing systems which are equally stringent as the Federal Backstop Carbon Pricing system. In 2021, the federal government updated its policy on recognizing the stringency of provincial carbon pricing systems and the price began rising incrementally $15 per tonne each year starting in 2022 to $170 tonne by 2030. In jurisdictions that do not have equivalent carbon pricing policies, the Federal Backstop Carbon Pricing system will apply.

There are two elements of the Federal Backstop Carbon Pricing system:

THE FUEL CHARGE: A charge on fossil fuels that is generally payable by fuel producers or distributors, with rates for each fuel that are equivalent to $10 per tonne of carbon dioxide equivalent (CO2e) in 2018, rising by $10 per year to $170 per tonne CO2e in 2030. The carbon fee for the federal backstop policy is revenue-neutral. Between 2019 and 2021 the revenue was recycled back to the citizens in their income taxes under line 449 “climate action incentive“. In provinces where the federal backstop Fuel Charge applies (Alberta, Manitoba, Newfoundland and Labrador, New Brunswick, Nova Scotia, Ontario, Prince Edward Island, and Saskatchewan), households receive quarterly deposits in their bank accounts or quarterly cheques. On February 14, 2024 the name of the refund was changed to the Canada Carbon Rebate. Canadians living in a province with the rebate can use the interactive tool at the bottom of this article to calculate their monthly rebate, as well as estimate monthly carbon tax costs.

OUTPUT-BASED CARBON PRICING (OBPS): For businesses and industries that qualify, they are enrolled in an Output-Based Carbon Pricing System. They pay a carbon price based on their emissions’ intensity relative to the best in the class of their industry, and surplus credits are traded. This component of the act protects emissions-intensive trade-exposed industries from trade pressures and carbon leakage. However, it does not send a strong enough signal to transform Canada’s energy systems to carbon decarbonize in alignment with the realities of the climate emergency we face. This assertion is supported by research by Clean Prosperity and the Parliamentary Budget Office. Citizens Climate Lobby Canada recommends that the carbon price should be economy-wide and thus the Output-Based Pricing System should be temporary, and ultimately replaced with Carbon Border Adjustment Mechanisms .

On February 14, 2024 were 3 major updates in Canada’s climate policy – the first two changes we lobbied for:

- The Climate Action Incentive Payment was renamed the Canada Carbon Rebate (and is a lesson to all to think deeply about the name of the rebate).

- The federal government is encouraging financial institutions to consistently label the Canada Carbon Rebate direct deposits that Canadians receive in their bank accounts every three months because most banks don’t clearly label the deposit (which partially accounts for why most Canadians don’t know they receive a rebate).

- The federal government is proposing, through legislative amendments in Bill C-59, to double the rural top-up to 20 per cent, in recognition of rural Canadians’ higher energy needs and more limited access to cleaner transportation options. (We are supportive of ongoing analysis of the distributional impacts of climate policies and refinements to the Greenhouse Gas Pollution Pricing Act).

GOVERNMENT WEBSITES

- https://www.canada.ca/en/department-finance/news/2024/02/government-announces-canada-carbon-rebate-amounts-for-2024-25.html

- https://www.pm.gc.ca/en/news/news-releases/2023/10/26/delivering-support-for-canadians-on-energy-bills

- http://www.parl.ca/DocumentViewer/en/42-1/bill/C-74/royal-assent

- https://www.canada.ca/en/revenue-agency/campaigns/cai-payment.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-449-climate-action-incentive.html

- https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/2019/Federal%20Carbon/Federal_carbon_pricing_EN.pdf

- https://www.canada.ca/en/services/environment/weather/climatechange/climate-action/pricing-carbon-pollution.html

OTHER REFERENCES

- CBC News. (2024, Jan 15). Carbon tax rebate perceptions: Believe it or not. https://www.cbc.ca/news/canada/calgary/carbon-tax-rebate-perceptions-believe-it-or-not-1.7079782?__vfz=medium%3Dsharebar

- Global News. (2023, April 1). Carbon tax to increase on April 1, 2023. https://globalnews.ca/news/9591715/carbon-tax-increase-april-1-2023/

- CTV News. (2023 Nov 1). Carbon pricing in Canada: What it is, what it costs, and why you get a rebate. https://www.ctvnews.ca/politics/carbon-pricing-in-canada-what-it-is-what-it-costs-and-why-you-get-a-rebate-1.6627245#:~:text=It%20started%20at%20%2420%20for,has%20a%20different%20carbon%20footprint.

- Angus Reid Institute. Carbon Tax Perceptions & Rebates. (2023, Nov.16) https://angusreid.org/carbon-tax-perceptions-rebates/

==================================================================================

Klimabonus

Question: What is Austria’s Klimabonus ?

Answer: In autumn 2021, the Austrian Government introduced an “eco-social tax reform” with a goal to achieve NetZero by 2040. The main tool of this package is a national carbon fee applied on fossil fuels. The national scheme does not replace energy taxes, it’s in addition. It prices emissions outside the pre-existing EU-ETS by covering transport and buildings which accounts for a further 40% of GHG emissions.

The Carbon pricing structure follows the logic of the EU Energy Taxation Directive (ETD), an “upstream” tax on production and importation. Products include: petrol, diesel, heating oil, coal, and natural gas, but the list could be expanded. Electricity is not subject to the policy because power plants above 20 MW of thermal output are covered by the existing EU-ETS.

Initially, it will follow the following price path: €30 in 2022; €35 in 2023; €45 in 2024; and €55 in 2025. In 2026 it will align with the EU wide policy. This might become a market with allowances, like the EU-ETS, or it may be allowed to continue as it meets acceptable criteria. This will likely be defined in 2025.

The Income (Dividend) is called “Klimabonus”. Austria has a great website for public explanation that directly promotes the financial benefit of choosing “climate friendly behaviour”. It is paid to all residents in Austria and rebates 100% of the carbon tax. In 2022, this is an equal payment of €500 per adult and €250 per child, and included a 2022 anti-inflation payment of €250. In 2023, regional access to public transport will be factored in. The bonus will increase as the carbon tax revenue increases.

There are some compensations for industry covering: Agriculture and forestry. Sectors exposed to carbon leakage can get partial refunds; especially energy intensive industries identified in the EU as “at risk”. Also, particular “hardship” cases can be made.

There are a set of related policy and tax changes to help with the transition that include:

- Lowering of labour taxes.

- Reduced burden on families with children.

- Reducing Corporate Income Tax in 2024.

- Reduced Tax for ecological measures for Corporations from 2023

- Home heating and insulation tax benefits.

- Home produced electricity tax benefits.

- All public transport in Austria with a single KlimaTicket.

The Austrian Klimabonus (Climate Income) is a model policy for other EU Member States to copy under the EU Green Deal (Fit for 55 legislation).

In short: A strong and repeatable example of Climate Income (CF&D).

|

More info on the Klimabonus

Question: Is there any extra info on the Klimabonus system?

Answer: The Austrian government made it clear that every euro taken from the national ETS will be given back to the citizens through the Klimabonus. This makes sure that the increase in price by national ETS is sustainable for the population.

The Klimabonus is given to all citizens resident in Austria. Adults receive a full part, while children under 18 receive a half-part. The Klimabonus is distributed yearly, through bank transfer or physical cheque for those who don’t have a bank.

People living in rural areas use their car more and have a bigger house to heat up. To compensate for this reality, the Klimabonus will be varied to take account of geographical criterias. Two criterias are taken into account: the urban density (how far do I have to travel to go to the supermarket or the children’s school) and access to public transport (e.g. train or bus availability). The increase in the Klimabonus goes from +33%, +66% to +100%. A family living in a rural area can have up to twice the basic amount.

The Klimabonus was distributed for the first time in 2022. Exceptionally, the amount of the Klimabonus was brought up at 250€, and was complemented by a 250€ anti-inflation payment. Starting 2023, the amount of the Klimabonus depends mechanically on what has been paid through the national price increase. The estimates are around 100€ per adult per year. In 2023, an urban family of four is expected to receive 300€, and the same family in the countryside up to 600€. As the carbon price will progressively rise, the annual amount of Klimabonus will rise mechanically.

The Klimabonus is a smart way to make the national Carbon Price sustainable. Recycling the money throughout the Klimabonus guarantees the transparency and the sustainability of the system. Moreover, the Klimabonus is increased for people living in rural areas, which makes the measure more fair.

| In short: Every euro spent though the national ETS is given back to the citizens of Austria with the Klimabonus. It is paid yearly by bank transfer, and will be increased for families living in rural areas to take into account the inequalities in how they can change their habits. Klimabonus is transparent, simple and fair. |

April and May 2024: Compilations

Laser Talks Redirecting Financial Flows and Climate Income Workshop Booklet: Laser Talks Booklet

Laser Talks in English from CCL France: Five Carbon Pricing Laser Talks

February 2024: Climate Income and Redirecting Financial Flows

Redirecting Financial Flows

Governments must swiftly enact subsidy and tax reforms, ensure polluters pay for greenhouse gas emissions, and reform financial systems to cease supporting fossil fuel projects both at the national and international level.

These policies must align with the science of a 1.5°C planet, requiring a 45% reduction in greenhouse gases by 2030 and true net-zero by 2040 in the Global North and by 2050 in the Global South.

Citizen engagement, human rights, and ongoing evaluations of efficacy, gender impacts and distributional analysis of impacts on households must be embedded into the development of the policies.

Climate Income

Governments

- Place a fee on greenhouse gas pollution from fossil fuels at the source (mine, well or port) starting at $15/tonne CO2e, increase $10/tonne annually.

- Return net revenues to households equally, protecting lower/middle class.

- A border adjustment on goods imported from or exported to countries without an equivalent price on carbon.

January 2024: Transforming the economy

Takeaway: Governments must enact specific policies that will redirect financial flows to ensure our planet’s continued prosperity.

Full version: As of 2023, humanity has crossed 6 of the 9 planetary boundaries necessary for our continued survival on this planet. Crossing these boundaries increases the risk of generating large-scale abrupt or irreversible environmental changes.

Unfortunately, our current economic system sacrifices nature and human health for quick economic gains. We need to change this harmful way of thinking, and we can do it.

The path forward is clear. We must redirect financial flows towards a thriving and equitable planet.

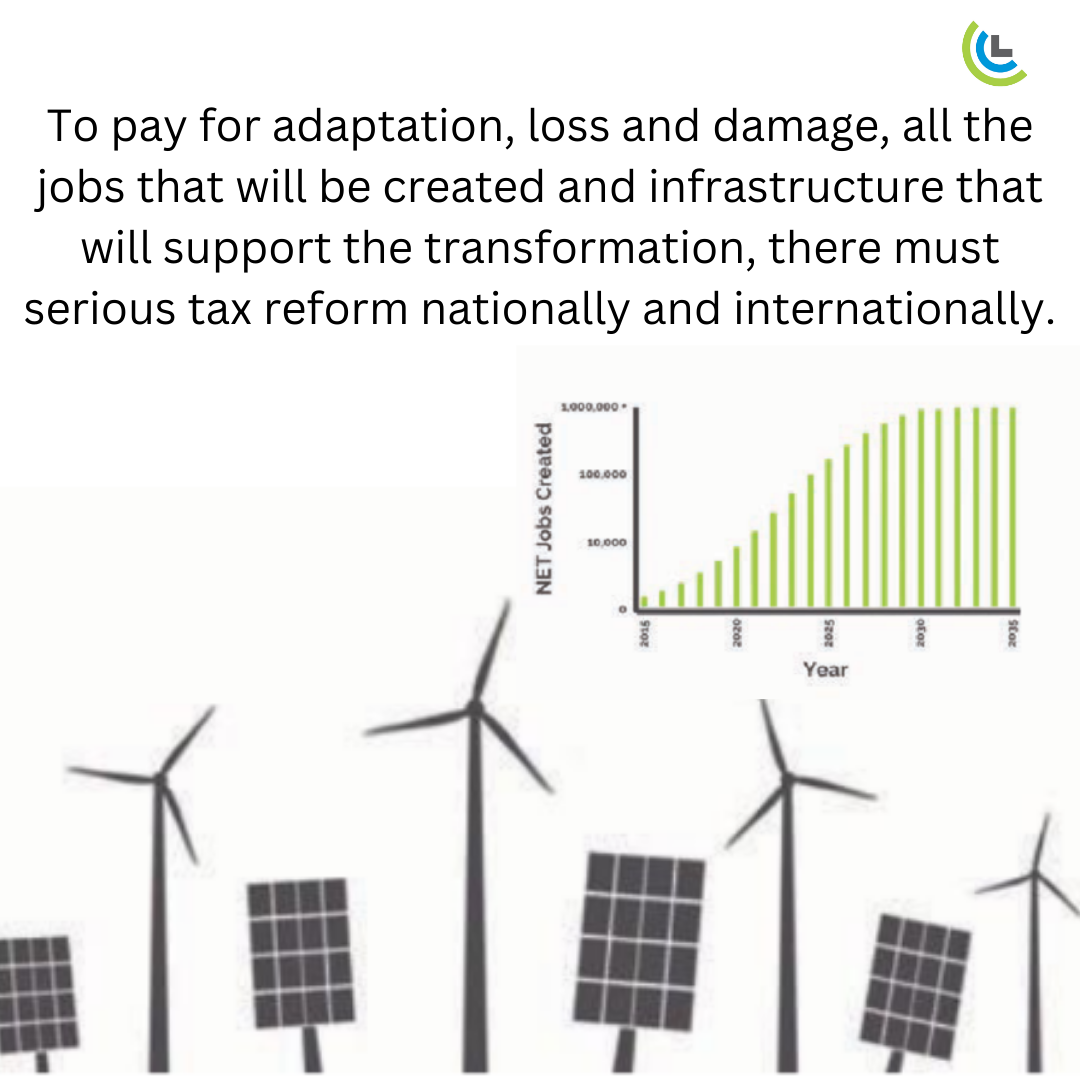

Governments must swiftly enact subsidy and tax reforms, ensure polluters pay for greenhouse gas emissions, and reform financial systems to cease supporting fossil fuel projects. These policies must align with the science of a 1.5°C planet, requiring a 45% reduction in greenhouse gases by 2030 and true net-zero by 2040. Citizen engagement as well as all human rights must be embedded into the ongoing development of all policies.

This won’t be simple, but we’ll need everyone around the world to work together to make this happen.

Here is a link to the Canva Images below

November 2023: How Fossil Fuels are a Key Driver of Global Inflation

Laser Talk – Fossil Fuels are a Primary Driver of Inflation = Fossilflation

Takeaway:

The primary driver of inflation around the world is fossil fuels. In fact there is a term for it: fossilflation. There is a simple solution: move away from fossil fuels. We need to do it fast, and we need to do it fairly. That is why at COP 28, Citizens’ Climate International is linking arms with many organizations and calling for a fossil fuel phaseout. By breaking free of coal, oil and gas, and replacing them by renewable energy sources, we will protect our planet and our economy.

The longer version:

The primary driver of inflation around the world is fossil fuels. Economies are addicted to fossil fuels at every level: mobility, energy production, agriculture and goods production. When the prices of oil and gas go up, every other price tends to go up. Actually, high fossil fuel prices are historically inseparable from inflation and economic crises. Mark Zandi, chief economist at credit rating agency Moody’s, said in an article for Vox that “every recession since World War II has been preceded by a jump in oil prices”. And there is a term for it: fossilflation.

Factors driving fossil fuel prices are many, and diverse. Most of the time, though, these come directly from producing countries, which raise and lower production, thus flooding or drying up the market. This is often used as a political tool, driving millions of people into despair. Here is just a sample of the many ways of how fossilflation happens:

- The market-rigging actions of the OPEC Plus cartel (including Russia);

- Profiteering on energy supply disruptions due to Russia’s invasion of Ukraine;

- Climate damages (a.k.a. climateflation) Extreme weather, climate and water-related events caused almost $1.5 trillion of economic losses in the decade to 2019, up from $184 billion in the 1970s, according to a World Meteorological Organization (WMO) report.

- Embedded energy costs across all classes of consumer products and business services;

- Food system effects including embedded fossil fuel costs and climate damage;

- Embedded climate risk and liability costs;

- Sovereign debt stresses driven by fossil fuels, including:

a. Public spending and sovereign debt burdens resulting from disaster response;

b. Direct spending on disaster response;

c. Extremely high, punishing interest rates linked to that spending compelled by actions a country did not initiate or decide;

d. All-time record fossil fuel subsidies ($7 trillion), linked to rigged fossil fuel price spikes;

e. Public spending to compensate consumers for unaffordable price shocks linked to higher embedded energy costs.

There is one solution: move away from fossil fuels. We need to do it fast, and we need to do it fairly. That is why at COP 28, Citizens’ Climate International is linking arms with many organizations and calling for a fossil fuel phaseout.

By breaking free of coal, oil and gas, and replacing them by renewable energy sources, we will protect our planet and our economy.

October 2023: Sulphur Termination Shock + Alarming Global Vital Signs

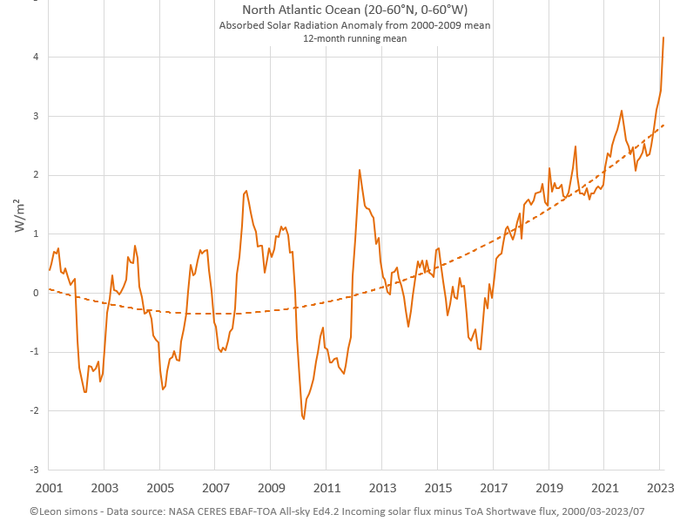

NASA CERES data from July in, North Atlantic Ocean Absorbed Solar Radiation Anomaly is off the chart. SOURCE: Leon Simons

The Interplay between Sulphur Termination Shock and Global Warming

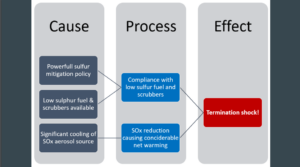

Takeaway: Reducing sulphate aerosol pollution will further exacerbate global warming

Sulphate aerosols are tiny particles or droplets in the Earth’s atmosphere that contain sulphuric acid (H2SO4) or sulphate (SO4^2-) ions. Human-made sources of sulphate aerosols include the burning of fossil fuels, smelting metals, certain fertilizers, biomass burning, marine shipping and waste incineration. Sulphate aerosols are hazardous to human health and ecosystems.

In their study titled “Climate Impact of Decreasing Atmospheric Sulphate Aerosols and the Risk of a Termination Shock,” Simons, Hansen, and duFournet discuss the potential relationship between global warming and a phenomenon referred to as a “termination shock” associated with decreasing atmospheric sulphate aerosols. The research explores how reducing sulphate aerosols, which have a cooling effect on the climate by reflecting sunlight, may have implications for global warming.

The authors argue that as efforts to reduce air pollution decrease sulphate aerosols in the atmosphere, this reduction in cooling particles could lead to a rapid increase in global temperatures, a scenario they term the “termination shock.” They base this argument on the idea that the decline in sulphate aerosols could remove a masking effect on the warming caused by greenhouse gases like carbon dioxide.

The authors argue that as efforts to reduce air pollution decrease sulphate aerosols in the atmosphere, this reduction in cooling particles could lead to a rapid increase in global temperatures, a scenario they term the “termination shock.” They base this argument on the idea that the decline in sulphate aerosols could remove a masking effect on the warming caused by greenhouse gases like carbon dioxide.

Their research suggests that while decreasing sulphate aerosols may contribute to improved air quality, it poses the risk of exacerbating global warming. This is consistent with their assessment that efforts to mitigate sulphate aerosols should be carefully managed to avoid unintended consequences on climate change.

Climate Impact of Decreasing Atmospheric Sulphate Aerosols and the Risk of a Termination Shock (2021) Leon Simons, James E. Hansen and Yann duFournet

The Rate of Global Warming During Next 25 Years Could Be Double What it Was in the Previous 50, a Renowned Climate Scientist Warns (2021) – Inside Climate News

Suggested Social Media Account: Leon Simons on Twitter: https://twitter.com/LeonSimons8

=======================================================

The Very Alarming Global Climate Vital Signs

Takeaway: The vital signs of our global climate are very alarming, but we still have time. We need to be brave and unite across the planet to unwind our global economy from fossil fuels.

It is not your imagination – heat and climate records are being shattered.

- the World Meteorological Organisation reported that June, July and August 2023 were the hottest three months globally on record, with unprecedented sea surface temperatures and much extreme weather

- A July 2023 study finds the collapse the Atlantic meridional overturning circulation, or AMOC, could happen far sooner than scientists have previously thought, possibly within a few decades, as a result of human-caused global warming.

- On September 18, 2023, Antarctic sea ice coverage was at a mind blowing record low.

- NASA-CERES data from July North Atlantic Ocean Absorbed Solar Radiation Anomaly is off the charts and is evidence that Sulphur Termination Shock may also be impacting our planet.

- The North Atlantic Ocean surface temperature is well above normal (and alarming).

These data underscore the need for rapid decarbonization of our global economic systems – in particular a managed global phaseout from fossil fuels which accounts for 85 percent of greenhouse gases in the past decade.

The findings in the sixth assessment synthesis report by the Intergovernmental Panel on Climate Change (AR6 IPCC, April 2023) were straightforward: there is enough worldwide funding available to swiftly decrease greenhouse gas (GHG) pollution, provided we address existing obstacles. It is essential for our governments to pass legislation that holds those responsible for pollution accountable and shifts financial investments away from fossil fuels.

The positive aspect is that once we achieve net-zero emissions within a decade or two, Earth’s climate systems will start to stabilize.

September 2023: IMF & Subsidies, Fossil Fuel Funded Climate Disinformation

The IMF, Carbon Pricing and Explicit and Implicit Fossil Fuels Subsidies

Here are two terms that anyone who wants to preserve a stable climate needs to know: explicit fossil fuel subsidies and implicit fossil fuel subsidies.

Explicit fossil fuel subsidies from governments directly reduce the price of fossil fuels, thus making it attractive to investors and consumers to buy. Implicit fossil fuel subsidies are the costs taxpayers and insurance are paying for the air pollution and climate impacts experienced because of dirty fossil fuels.

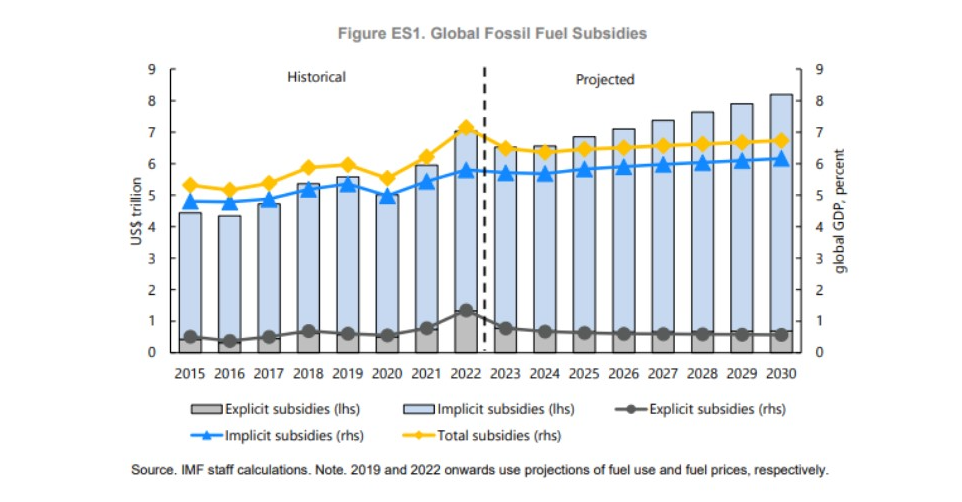

On August 24, 2023, the International Monetary Fund (IMF) released a report. The conclusion of this report was that subsidies for oil, coal, and natural gas cost the equivalent of 7.1% of global gross domestic product.

Explicit subsidies have more than doubled since 2020 but are still only 18% of the total subsidy amount, while nearly 60% is due to implicit subsidies.

Here is a hopeful conclusion from the report: “Full fossil fuel price reform would reduce global carbon dioxide emissions to an estimated 43 percent below baseline levels in 2030 (in line with keeping global warming to 1.5-2C), while raising revenues worth 3.6 % of global GDP and preventing 1.6 million local air pollution deaths per year.”

Making polluters pay (a.k.a carbon pricing) offers us the exact tool needed to ensure this price reform. In fact, the IMF Managing Director Kristalina Georgieva at the Paris Summit in June said, “Our analysis shows that without a carbon price, there is no chance that we will meet the 1.5 degrees Celsius target by 2030. We will miss it.”

Our only home, Earth, has just passed through the hottest three months on record. With the fires, floods, horrendous storms, cryosphere melting and the threats to the Gulf Stream, it is obvious that the impacts of climate change are no longer just a concern for future generations, but are a very real threat at our doorstep. We must listen to the experts and cooperate to enact or strengthen our essential climate policies such as carbon pricing going forward. Happily there are 70 carbon pricing initiatives world wide and the African Summit issued a unanimous call for world leaders to support global price on carbon pollution on September 6, 2023.

IMF Subsidies Report August 2023

==================================

The Fossil Fuel Industry Funded Climate Disinformation for Decades

Even to this day, there are individuals who deny or downplay the link between the burning of fossil fuels and the impacts that pollution has on our climate and health. How did this happen?

Key players in the fossil fuel industry knew decades ago that burning coal, oil, and methane gas to warm our homes, power our cars, and generate electricity was warming the planet. Instead of acting on the knowledge, they began financing a massive disinformation campaign. Now, as a consequence, youth are having to fight for their inalienable right to have a safe and liveable future.

Happily, governments are now beginning to sue Big Oil including Puerto Rico, Delaware, Hoboken, New Jersey and the fifth largest economy in the world, California, for their deceptions.

Suggested readings:

- Climate Cover-Up (2009) By James Hoggan and Richard Littlemore

- Merchants of Doubt: How a Handful of Scientists Obscured the Truth on Issues from Tobacco Smoke to Climate Change (2011) by Naomi Oreskes

- Oil’s Deep State: How the petroleum industry undermines democracy and stops action on global warming – in Alberta, and in Ottawa (2017) Dr. Kevin Taft

- The New Climate War: The Fight to Take Back Our Planet (2021) By Michael E. Mann

- The Petroleum Papers: Inside the Far-Right Conspiracy to Cover Up Climate Change (2022) By Geoff Dembecki

MAY 2023: Canada's Climate Income Policy Cuts GHGs + Climate Income Reduces Ineaquality

Canada’s Climate Income Policy Cuts GHGs

In June 2018, the Greenhouse Gas Pollution Pricing Act (GGPPA) achieved Royal Assent and became law of the land in Canada. This policy is a form of Climate Income, and it came into force on April 1, 2019. Less than a year later, the world was in the COVID pandemic.

In April, Canada released its 2023 National Inventory Report. Canada’s National Inventory Report lags two years behind the actual year. Thus, for the first time, we could determine the impacts of the GGPPA in the absence of COVID lockdown.

In 2021, Canada produced 670 million tonnes of carbon dioxide and its equivalents in methane, nitrous oxide, and synthetic gases as pandemic restrictions began to ease – 53 million tonnes less in emissions in 2021 than it did in 2019 — the year before the pandemic hit.

The government report’s conclusions are in line with a similar report from the independent Canadian Climate Institute released in February 2023.

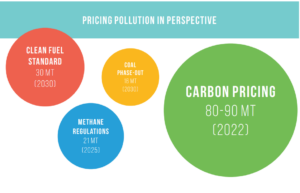

Carbon pricing is the cornerstone policy of Canada’s climate plan and in 2018 was predicted to account for more than half of reductions of greenhouse gases (see image on left).

We know from plenty of other studies that most Canadians come out ahead – especially the lower and middle income Canadians who are currently being challenged by the inflation crisis like many around the world.

Of note, Austria enacted a similar carbon pricing policy called Klimabonus earlier this year and the German government has proposed a Klimageld and is committed to returning carbon pricing revenues too.

In conclusion, Canada is showing the world how a country can cut greenhouse gas emissions and protect the poor and middle class as we transition off of fossil fuels and to a fair and sustainable world for all.

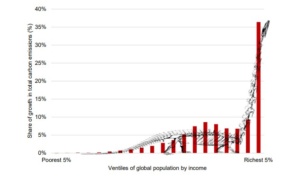

The Carbon Inequality Brontosaurus Chart

In September 2020, the Stockholm Environment Institute released an insightful report (1). In the 25 years from 1990 to 2015, annual global carbon emissions grew by 60%, approximately doubling total global cumulative emissions.

The disproportionate impact of the world’s richest people is unmistakable and the chart looks like a brontosaurus – with a tall neck and long tail.

The disproportionate impact of the world’s richest people is unmistakable and the chart looks like a brontosaurus – with a tall neck and long tail.

The “tall neck” is the result of the fact that nearly half of the total growth in absolute emissions was due to the richest 10%, with the richest 5% alone contributing over a third (37%). The emissions linked to the top 1% alone grew more than three times as much as those linked to the bottom 50%.

The bottom 50% comprises the “long tail”. Since the bottom 50% has 50 times more people in it, the average per capita consumption emissions linked to the top 1% in 2015 were over 100 times greater than the average per capita consumption emissions of the poorest half of the world’s population.

The global carbon budget is a precious natural resource. These results suggest a need for increased attention to be paid to the ongoing porcine impact of the small minority of the world’s richest citizens and the enormous and continuing economic development needs of the world’s poorest citizens.

Our socio-economic and climate policies most certainly can be designed to address carbon inequality. In fact, Canada’s national backstop carbon pricing policy addresses the “brontosaurus in the room” (2).

Data from Canada’s Parliament Budget Office confirms this assertion (3). Canada’s carbon pricing policy is a form of carbon fee and dividend. It is also known as climate income. Canada has put a revenue-neutral price on GHG pollution at the source, and gives 90% of the money back to the people equitably, regardless of income or carbon footprint. The other 10% of carbon fees collected go to the MUSH sector: Municipalities, Universities, Schools, and Hospitals. It also reduces GHGs (4) without creating burdensome tax policies for governments to administer.

References:

(1) The Carbon Inequality Era | SEI (2020)

(2) The Greenhouse Gas Pollution Pricing Act (2018)

(3) Fiscal and Distributional Analysis of the Federal Carbon Pricing System (2019)

(4) Beyond Paris: Reducing Canada’s GHG Emissions by 2030 (2021)

Pollution pricing with equal dividends enhances equity and development

Currently, 49 countries price greenhouse gas pollution. Two countries, Austria and Canada, price greenhouse gas pollution and return the dividends back to the people equally.

In a November 2021 peer-reviewed paper in Nature, researchers reported that a global 2C temperature* can be met while also increasing well-being, reducing inequality and alleviating poverty, if each country or region imposes a substantial carbon tax and refunds the revenues to its citizens on an equal per capita basis. When revenues are not used in such a progressive way, the model also verified that many of the poorest citizens are negatively impacted in the short-to-medium term. These results indicate that it is possible for a society to implement strong climate action without compromising goals for equity and development.

*With a few more policies in play we can achieve the 1.5C goal too.

————————————————————————————————————————

Carbon Inequality in the G20 Nations

In December 2015 at the Paris Agreement, Oxfam presented their paper on Extreme Carbon Inequality.

As one can see in the graph below in G20 countries for which they had data, the per capita GHG emissions for the richest top 10% of households in every country were well above average. Whereas on the flip side, the bottom 50% and bottom 40% of households’ GHG emissions were below average. This explains why the carbon pricing program of climate income where we have data (USA, Australia, and Canada) on average at least ⅔ of households come out ahead.

Most countries have similar income distributions. You can use Wolfram Alpha to determine your country’s income distribution pattern and Gini Index relative to Australia, Canada, and the USA and then infer that the results would be anticipated to be similar.

APRIL 2023: IPCC + NEW Antarctica Study + CCS + Nuclear + Rights

Five Laser Talks

- IPCC AR6 Synthesis Report

- New Antarctica data

- CCI’s Position on CCS

- CCI’s Stance on Nuclear

- Our Rights and a Liveable World

IPCC AR6 Synthesis Report: Join Us On the Bomb Squad

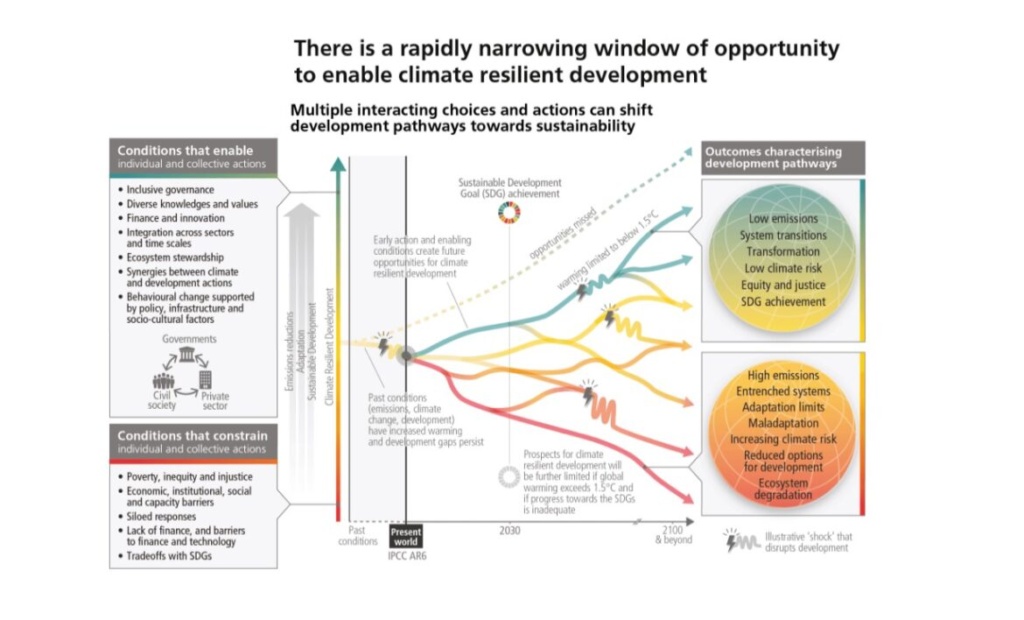

On Monday, March 20, 2023, in Interlaken, Switzerland, the IPCC released its final assessment report in its sixth cycle (AR6) – the Synthesis report. The report is a how-to guide on diffusing the climate time-bomb.

The planet will reach 1.5 C global temperature rise in the early 2030s. Now there is an urgent call for developed nations to reach net-zero by 2040 and developing nations by 2050. The good news is that it is achievable.

The United Nations Secretary-General António Guterres announced a plan to massively fast-track climate action. He has proposed a G-20 Climate Solidarity Pact that includes an Acceleration Agenda which calls for:

- an end to coal, net-zero electricity generation by 2035 for all developed countries and 2040 for the rest of the world,

- a stop to all licensing or funding of new oil and gas, and any expansion of existing oil and gas reserves.

- GHG needs to go down now and be cut by almost half by 2030.

The report finds that the economic benefits for people’s health from air quality improvements alone would be roughly the same, or possibly even larger than the costs of reducing or avoiding emissions. To be effective, these choices need to be rooted in our diverse values, worldviews, and knowledge, including scientific knowledge, Indigenous Knowledge, and local knowledge.

Increasing finance to climate investments is important to achieve global climate goals. The synthesis report is quite clear that there is sufficient global capital to rapidly reduce greenhouse gas pollution if existing barriers are reduced. Global capital is all the savings held by banks, pensions, financial institutions, governments, and individuals. Governments, through public funding and clear signals to investors, are key in reducing these barriers.

Investors, central banks, and financial regulators must also play their part. That is because much of the trillions of dollars of financing for fossil fuels come from the private sector. Thus, redirecting private sector finance away from fossil fuels is key. Policies such as an incrementally rising price on carbon pollution pricing with equal dividends to households, carbon border adjustment mechanisms, reforms at the World Bank, and climate risk disclosure rules for financial institutions would provide clear signals to redirect financial flows away from fossil fuels while not burdening the taxpayer.

One of the key conditions for enabling a liveable future is inclusive governance. We are part of network that has been empowering volunteers to speak about climate finance issues since 2007. Join us on the bomb squad.

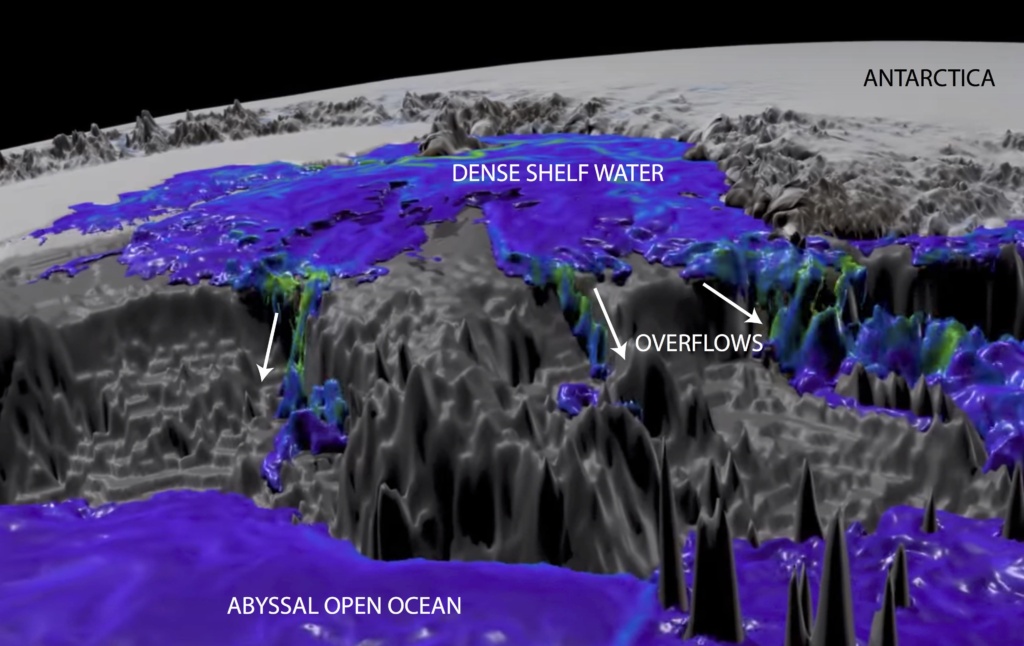

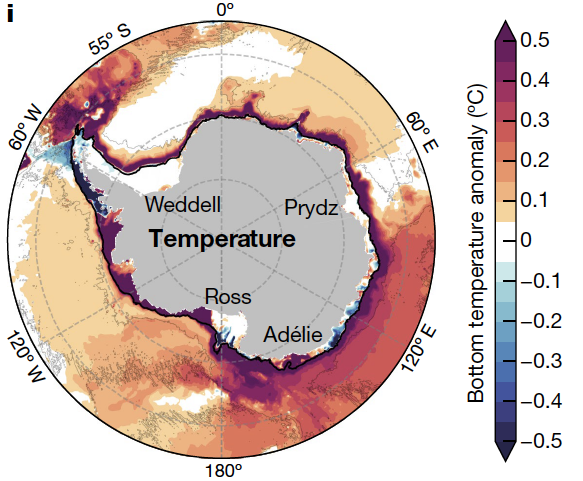

How to Defuse the Antarctic Climate Bomb

A new paper in Nature published in the last week of March 2023, shows how meltwater increases around Antarctica are set to slow down dramatically the Antarctic overturning circulation, with a potential collapse this century. This will devastate the marine biodiversity around Antarctica because the food chains will collapse. The good news, this is avoidable.

In the simulations, scientists found that when they include upcoming meltwater changes around Antarctica, the abyssal overturning cell declines by more than 40% by 2050.

In the simulations, scientists found that when they include upcoming meltwater changes around Antarctica, the abyssal overturning cell declines by more than 40% by 2050.

This is driven by a reduction in the density of surface water around the Antarctic margin, which in turn sees greater intrusion of warm Circumpolar Deep Water onto the shelf.

The resulting subsurface warming in the Amundsen – Bellingshausen Seas is particularly concerning. This would lead to an amplifying feedback with further ice shelf melt and sea-level rise, in a region that we know from paleo records is vulnerable to ice sheet collapse.

The resulting subsurface warming in the Amundsen – Bellingshausen Seas is particularly concerning. This would lead to an amplifying feedback with further ice shelf melt and sea-level rise, in a region that we know from paleo records is vulnerable to ice sheet collapse.

Another concern is that as the Antarctic overturning slows, nutrient-rich water is left to accumulate on the seafloor, instead of being returned to the surface to feed marine ecosystems.

A reduction in the ocean uptake of carbon dioxide has also been documented in this same study. Another amplifying feedback.

Final important point: the projections were run under a ‘business as usual’ scenario. Deep and urgent emissions reductions will give us a chance of avoiding an ocean overturning collapse.

The overall conclusions of the IPCC AR6 Final Synthesis report were clear: we can diffuse the climate time bomb and there are the financial resources globally available to do so.

To have a chance of saving the Antarctic ecosystem, we must directly address the primary source of greenhouse gas pollution: fossil fuels. More specifically, we must redirect trillions of dollars of financial flows away from fossil fuels if we are to prevail. As well, we must be mindful that some within the fossil fuel industry have been running a disinformation campaign for decades to confuse the masses.

In the 2000s many of us started learning about the science of climate change. In the 2020s, it is imperative that we all learn the basics of climate finance. As the Mandalorian would say: This is the way. The key now is public understanding of the powerful ways to redirect financial flows globally away from fossil fuels and towards a thriving and equitable future. That is our wheelhouse at Citizens’ Climate International.

We need you on the bomb squad. Join us to find out more.

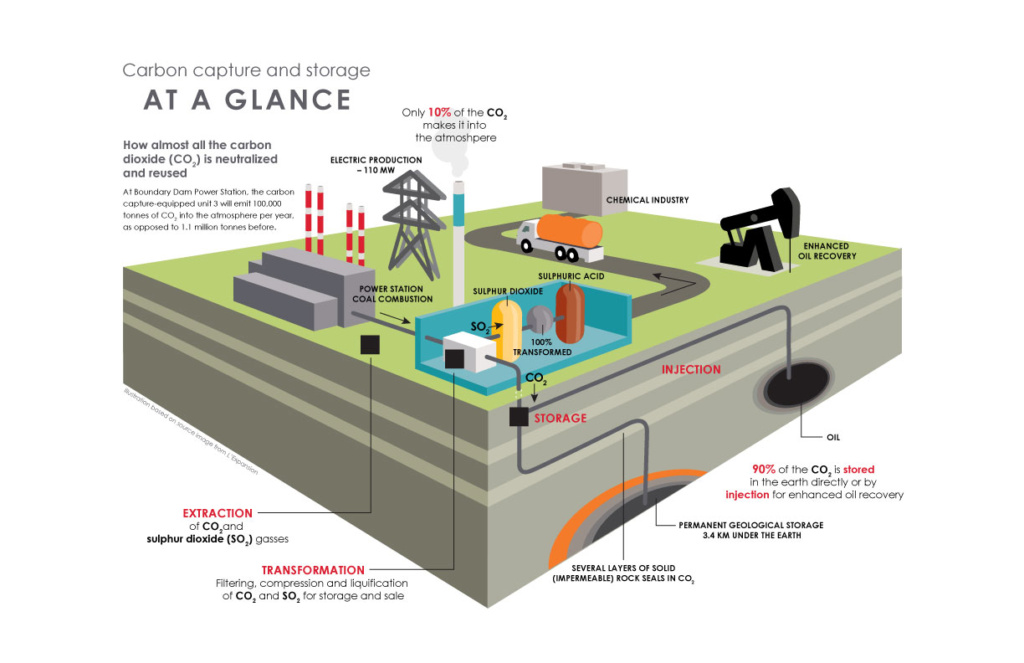

CCI’s Stance on Carbon, Capture, and Sequestration

Carbon Capture and Storage (CCS) is a general term for a range of different industrial processes that can separate carbon dioxide (CO2) emissions from smokestacks and store it underground indefinitely as toxic waste. Citizens’ Climate does not oppose or support any specific technologies; our goal is to stop climate change from hurting people and nature, not to aid or disadvantage any industry.

It should be noted that a 2017 study found that without adequate carbon pricing, CCS deployed at the scale required to meet climate targets is unlikely.

In June 2022 the International Energy Agency reported that CCS facilities currently capture almost 45 megatonnes of CO2 globally. Project developers have announced ambitions for over 200 new capture facilities to be operating by 2030, capturing over 220 Mt CO2 per year. However, only around 10 commercial capture projects under development have official financial approval as of June 2022. Nevertheless, even at such a level, CCS deployment would remain substantially below what is required in the Net Zero by 2050 Scenario. This is now even more problematic, because the new IPCC AR6 Synthesis Report (March 2023) calls for industrialized countries to reach net zero by 2040.

CCI is fully supportive of the UN High-Level Expert Group on Net-Zero commitments (HLEG) report Integrity Matters: Net zero commitments by businesses, financial institutions, cities, and regions. One of the key recommendations is that technologies must come as advertised.

One of the key conclusions of the final IPCC AR6 Synthesis Report (March 2023) was clear – existing and currently planned fossil fuel projects are already more than the climate can handle.

Given the inequitable and catastrophic impact that exceeding a global temperature rise of 1.5 °C will have on everything and everyone, everywhere, planning for any new fossil fuel infrastructure on the premise that it can be reversed by unproven carbon capture and sequestration capacity is indefensible.

CCI’s Position on Nuclear Energy

Citizens’ Climate International does not advocate for or against nuclear power generation.

We understand the science that shows the low-carbon generating capacity of nuclear power, and we understand the objections that many people raise, regarding risk to health and safety, and to the environment.

Dr. Hansen—the world’s preeminent climate scientist and a member of our sister organization Citizens’ Climate Lobby’s Advisory Board—supports nuclear energy as a way to help speed the transition from fossil fuels to a zero-emissions energy economy.

Fourth Generation nuclear power generation can theoretically reduce the amount of radioactive waste the world must deal with, but cost projections for the business model are uncertain, and reactors using this technology will take decades to develop. As with any energy technology or climate solution, we stick to our focus on a livable future for all—that means energy systems a) should not pollute, b) should not disrupt the climate system, c) should operate safely at all times, and d) should not impose massive hidden costs on society and nature.

CCI’s aim is to support citizen volunteers around the world in their efforts to create political will that will redirect financial flows away from climate-destabilizing pollution and towards a thriving and equitable future. This is a heavy lift that deserves constant attention to the highest standards. We agree with the United Nations’ Integrity Matters report: net zero strategies need to be verifiable, and materially low-carbon and clean.

As the adage says, “He who runs after two hares will catch neither.”

Laser Talk: Our rights and a livable world

A livable future is a human right. We are starting to see institutions, and courts of law, respond to this principle by applying precedent and aligning climate action obligations with the basic moral duty to honor and protect human rights.

On December 10, 2023, the world will celebrate 75 years since the United Nations (UN) established the Universal Declaration of Human Rights. (General Assembly resolution 217 A)

In the 21st century our rights to a livable world are gaining traction, and none too soon.

On July, 28, 2022 the UN General Assembly declared access to clean and healthy environment a universal human right (In favour: 161, Abstentions: 8, Against: 0)

On March 29, 2023 the UN General Assembly backed a landmark Pacific-led resolution calling for an advisory opinion from the International Court of Justice (ICJ) on climate obligations. Through the resolution, world leaders asked the ICJ to form an advisory opinion clarifying international legal consensus on climate change’s impacts on human rights and the rights of future generations. The opinion will be non-binding, but experts say it could influence the outcome of climate-related court cases around the world. Advisory opinions are not judgements, and the ICJ does not have the power to jail, fine or punish individuals or companies solely on the basis of such advisory opinions. They do, however, carry legal weight and moral authority that can influence future decisions.

On December 9, 2019, the national Commission on Human Rights of the Philippines announced the findings and recommendations from its path-breaking four-year inquiry into the human rights impacts of climate change in the Philippines and the contribution of 47 Carbon Major companies to those impacts. The inquiry is the first of its kind to undertake a serious examination of how the world’s largest producers of fossil fuels have contributed to climate-related human rights violations. The Commission found that climate change constitutes an emergency situation that demands urgent action. The Commission further concluded that Carbon Major companies played a clear role in anthropogenic climate change and its attendant impacts. The Commission found that, based on the evidence, Carbon Major companies could be found legally and morally liable for human rights violations arising from climate change.

On December 20, 2019, the Dutch Supreme Court, the highest court in the Netherlands, upheld the previous decisions in the Urgenda Climate Case, finding that the Dutch government has obligations to urgently and significantly reduce emissions in line with its human rights obligations. A truly historic outcome!

On November 29, 2022 sixteen Puerto Rican Towns filed suit under the Racketeer Influenced and Corrupt Organizations (RICO) Act against Chevron, ExxonMobil, Shell, and other fossil fuel giants for colluding on climate denial. “The 2017 Atlantic hurricane season, featuring six major hurricanes and more than a dozen named storms, caused at least $294 billion worth of damages in the U.S. territory,” Reuters reported, citing the lawsuit. “Hurricanes Irma and Maria contributed to an estimated 4,600 deaths and the failure of critical infrastructure in Puerto Rico, the municipalities said.”

In 2023, an explosion of climate cases are in the queue. Here is just a sample.

On March 29, 2023, thousands of elderly Swiss women joined forces in a groundbreaking case heard at the European Court of Human Rights, arguing that their government’s “woefully inadequate” efforts to fight global warming violate their human rights.

In the USA, the court will see a case go to trial when a group of children and young people between the ages of five and 21 square off against the state of Montana. Over two weeks in June, they will argue that the US state is failing to protect their constitutional rights, including the right to a healthy and clean environment, by supporting an energy system driven by fossil fuels. They will also say climate breakdown is degrading vital resources such as rivers, lakes, fish and wildlife which are held in trust for the public.

In Canada, a ruling is expected this year in the country’s first climate lawsuit to have had its day in court. Seven young people made history last autumn when they challenged the Ontario government’s rollback of its 2030 greenhouse gas emissions reduction target. The case has already made history being the first climate case in Canadian history to make it this far under the Canadian Charter of Rights and Freedoms. Two of the youth plaintiffs, Sophia Mathur and Alex Neufeldt, are members of CCL Canada.

In Mexico, young people have led several important court cases challenging the slow pace development of the country’s clean energy system. The supreme court is due to decide whether they are allowed to seek justice in at least one case.

Natural laws have always existed, and there is a legal basis for living in harmony with nature. We are now retracing our steps.

Pertinent resources

- The Global Trends in Climate Litigation 2022 (Report, Grantham Research Institute, LSE)

- Why 2023 will be a watershed year for climate litigation

- United Nations (March 2023): Women, girls and the right to a clean, healthy and sustainable environment – Report of the Special Rapporteur on the issue of human rights obligations relating to the enjoyment of a safe, clean, healthy and sustainable environment

MARCH 2023: Bridgetown Initiative

Laser Talk: Why We Support the Bridgetown Initiative

We all know the importance of balancing the books. Thus, it is not an exagerration to think that our global economy is on the verge of collapse. Dividends are being paid out, but at the expense of people and planet. Our financial operating system is out of date. We’ve ignored the notifications for so long that inequality and climate catastrophe are affecting our daily lives. We need to invest to heal inequalities, restore health to the planet and build resilience to future crises.

Barbadoes Prime Minister Mia Mottley’s Bridgetown Initiative would address immediate fiscal concerns and increase vulnerable countries’ resilience to shocks. It is gaining support and beginning to work.

Many of the Bridgetown initiatives require no financial transfers from developed country taxpayers. They are based on the concept that if ideas change minds, then the global economic system will change for the greater good:

- Developed countries can exercise influence to push the World Bank and other multilateral development banks (MDBs) to better leverage their balance sheets. Recommendations from a G20 expert group could leverage an additional $1 trillion for climate and development finance.

- US and European leaders can deliver promises of emergency liquidity using $100 billion of Special Drawing Rights, through the International Monetary Fund and MDBs creating fiscal space in developing countries, quickly, and without harmful conditions.

- Create a Loss and Damage funding mechanism will support climate equity at the UN climate conferences. Political support for the UNSG proposal to tax windfall profits from oil and gas exports could be an important first step.

- Innovative funding mechanisms could unlock additional political capital for a paradigm shift in resource mobilization. A Global Climate Mitigation Trust, borrowing on capital markets, backed by $500bn of Special Drawing Rights, donor guarantees, or similar instruments is another proposal.

- Heightened recognition of the nexus of climate and development stimulates new ways to engage the private sector. Innovative instruments (debt for equity swaps, state-contingent debt instruments, regional guarantee platforms) provide financing options for recipient countries, including the use of instruments that incentivize private finance, and could stimulate increased South-South investments.

The financial operating system is out of date. The Bridgetown Initiative will change mindsets and requires a relatively modest financial investment from taxpayers in the Global North through the multi-lateral development banks. It will rebalance our financial system through fair and sustainable development to avert environmental, economic and societal collapse.

FEBRUARY 2023: Bretton Woods Reforms and Integrity Matters

February 2023 Laser Talks: Bretton Woods Reforms and Integrity Matters

Bretton Woods Reforms

THE PROBLEM

The International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC) have shown that fossil fuel infrastructure that is planned or already under development will exhaust the remaining carbon budget. We need a planned retreat from fossil fuels now.

PRIVATE FINANCES MUST BE LEVERAGED

Public money (tax dollars) can’t fund the net-zero transition and currently private sources of capital aren’t sufficiently incentivized to fill the gap. For example, the Glasgow Financial Alliance for Net Zero (GFANZ) banks and insurers with more than $140 trillion of assets, committed to net-zero emissions by 2050. But just a fraction of that money has been invested. Sadly, GFANZ financial institutions have poured $270 billion for new fossil fuel infrastructure according to a new report “Throwing Fuel on the Fire”.

END FOSSIL FUEL COLONIALISM

At COP 27 in Egypt Prime Minister Mia Mottley of Barbados and Vice President Al Gore called out fossil fuel colonialism in the global financial system. They both shared a statistic that crystalised the problem. On average, firms in the Global South pay seven times the interest rates compared to companies in Canada and the USA. How are Global South countries ever supposed to transition their economies? Help is needed now with overcoming several investment hurdles including debt-crises in the emerging economies, credit-rating constraints, and foreign-exchange risks.

REFORM IS COMING

Earlier in 2022, the World Bank was tasked by the U.S. Treasury—its largest shareholder—with developing a comprehensive ‘Evolution Roadmap’. In January 2023 it was released. Here is a statement from the World Bank.

“On January 11, the World Bank Group’s Boards of Executive Directors discussed with Management an Evolution Roadmap for the Bank Group to better address the scale of development challenges such as poverty, shared prosperity, inequality, and cross-border challenges including climate change, pandemics, and fragility, conflict and violence, that all affect the Group’s ability to achieve its mission. The Board expressed preliminary views on Management’s initial draft, Evolving the World Bank Group’s Mission, Operations, and Resources: A Roadmap.

THE TRANSFORMATION POTENTIAL IS HUGE

The World Bank, the IMF must step in and they are about to do so. On January 17, 2023 in Bloomberg News is “the World Bank is set to wield huge influence over how the energy transition is financed, potentially dwarfing the promised efforts of Wall Street giants like JPMorgan Chase & Co. or BlackRock Inc. to help eliminate emissions.”

At COP 27, PM Mia Mottley introduced a plan for 500 billion dollars of public money to be invested to unlock five trillion dollars in investment. For perspective, at COP 26, PM Mia Mottley cited a statistic that by November 2021 nine trillion dollars of public money was used to buffer economies globally during the COVID pandemic.

The public money at the World Bank belongs to the people of this planet. It is our right to kindly ask that it be used to create an equitable and thriving planet.

IN A NUTSHELL

Trillions of dollars of private sector money could be leveraged at the World Bank Group towards a thriving and equitable planet. It is our right and responsibility as citizens all over the world to help with this transformation. It is our money.

====================================================================

Integrity Matters

At COP 27 in Egypt the UN High-Level Expert Group on net-zero commitments (HLEG) launched its report Integrity matters: Net zero commitments by businesses, financial institutions, cities and regions The goal of the group was to develop stronger and clearer standards for net-zero emissions pledges by non-State entities. The group was led by the Honourable Catherine McKenna, Canada’s former Minister for the Environment and Climate Change

Secretary-General António Guterres said: “A growing number of governments and non-state actors are pledging to be carbon-free – and obviously that’s good news. The problem is that the criteria and benchmarks for these net-zero commitments have varying levels of rigor and loopholes wide enough to drive a diesel truck through. We must have zero tolerance for net-zero greenwashing.”

The HLEG resource aims to develop stronger and clearer standards for net-zero emissions pledges by non-state entities and speed up their implementation. The report provides clarity in four key areas – environmental integrity, credibility, accountability and the role of governments.

The report is organized under five principles and ten recommendations.

Five principles

1. Ambition which delivers significant near— and medium —term emissions reductions on a path to

global net zero carbon dioxide emissions by 2050 and net zero greenhouse gas emissions soon after

2. Demonstrated integrity by aligning commitments with actions and investments

3. Radical transparency in sharing relevant, non-competitive, comparable data on plans and progress

4. Established credibility through plans based in science and third-party accountability

5. Demonstrable commitment to both equity and justice in all actions

Ten Recommendations -detail what non-state actors need to consider through each stage of their progress towards achieving net-zero ambitions and addressing the climate crisis.

1. Announcing a Net Zero Pledge

2. Setting Net Zero Targets

3. Using Voluntary Credits

4. Creating a Transition Plan

5. Phasing out of Fossil Fuels and Scaling Up Renewable Energy

6. Aligning Lobbying and Advocacy

7. People and Nature in the Just Transition

8. Increasing Transparency and Accountability

9. Investing in Just Transitions

10. Accelerating the Road to Regulation

IN A NUTSHELL

Here are some key takeaways from the HLEG Integrity Matters: Technologies must come as advertised, there are limits on the use of carbon offsets, no new fossil fuel infrastructure, a plan for unwinding from fossil fuels, no being aligned with groups that lobby for fossil fuels and investments must be made in a just-transition.

More information: On Valentine’s Day, the Honourable Catherine McKenna joined Citizens’ Climate International for a fireside chat with our CCL France leader . A considerable chunk of that conversation centered around the UN’s Integrity Matters report. You can watch it:

Laser Talks Compilations

For the curious-minded:

- Want to dive deeper and learn about authentic, explicit and implicit carbon pricing as well as the intricacies of Article 6.8 of the Paris Agreement – then peruse this handbook made in the summer of 2022.

- CCL USA has a Laser Talks Directory listed under six categories: Climate Science, Impacts, Policy Design, Technology, Politics, and International. Go here for more information.

- CCL Canada has a webpage dedicated for Canadian Laser Talks.

- LCC France has a webpage dedicated Cours Lasers pour La France

- CCL Europe is building their own regional specific ones here.