What is Carbon Fee and Dividend or Climate Income?

Our preferred policy solution to the climate crisis is to put a price on carbon pollution and allocate the proceeds directly to the people via a monthly dividend check, to spend as they see fit. Since 2009, Citizens’ Climate Lobby (CCL) USA has been advocating for this policy under the name “Carbon Fee and Dividend” and now it also known as “Climate Income”.

Climate Income is the policy that climate scientists and economists alike say is the best first-step to reduce the likelihood of catastrophic climate change from global warming. Adopting carbon fee and dividend will solve most of the climate crisis, reduce inequality, improve health and have a positive impact on gender inequality.

Carbon Price

Polluters pay depending on how much they contribute to climate change, encouraging them to reduce how much fossil fuel they burn and to make cleaner decisions.

Climate Income

The money is then returned in equal shares to the population so that families do not suffer due to cost increases. Governments do not keep the money from the carbon tax.

Border Adjustments

To persuade other countries to do the same, international trade is balanced. This protects jobs and industry from loopholes or ‘carbon leaks’.

The Evidence:

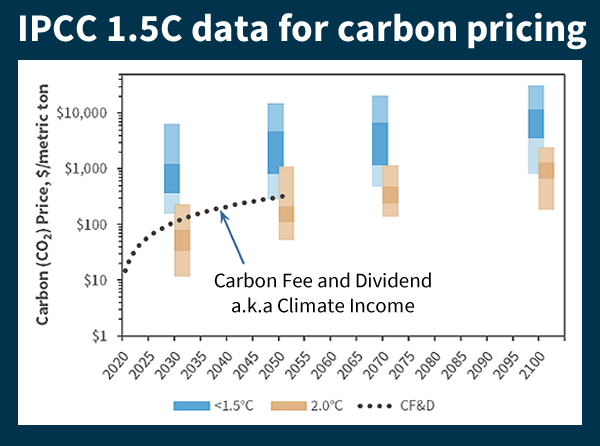

The IPCC 1.5C Report

In 2016, the 195 nations who signed the Paris Agreement asked the Intergovernmental Panel on Climate Change (IPCC) to study the implications of a 1.5°C global temperature target. Their report, entitled Global Warming of 1.5°C, was released in October 2018. This report clarifies the benefits of holding the modern-day rise in global average temperature to 1.5°C rather than 2.0°C.

Carbon Pricing

Under any circumstances, high prices on GHG emissions will be necessary to cost-effectively stay below 1.5°C. To prevent a tax revolt, the money collected must be returned to the people.

The IPCC report underscores the importance of quickly adopting strong carbon pricing. Most importantly, Climate Income enacted globally would cut emissions 50 percent by 2034, a level consistent with the IPCC recommendation for staying below 1.5°C.

Economists Agree

“A carbon tax is most effective… it should increase every year… a border adjustment should be established… [F]or fairness and political support all the money should be returned to citizens.”

Economists’ Statement

The Largest Public Statement of Economists in History

More Consensus:

- “Carbon pricing should be primary policy” OECD 2013

- The FASTER principles for Successful Carbon Pricing OECD 2015

- June 2020 World Economic Outlook (WEO) “Initial green investment push combined with steadily rising carbon prices” IMF Oct 2020:

- Ove 3000 US economists including all Nobel Laureates call for steadily rising Carbon price.

- Over 1000 European Environmental and Resource Economists call for increasing Carbon prices.

- Canadians For Clean Prosperity data for carbon pricing rebated to citizens reduces emissions and income inequality.

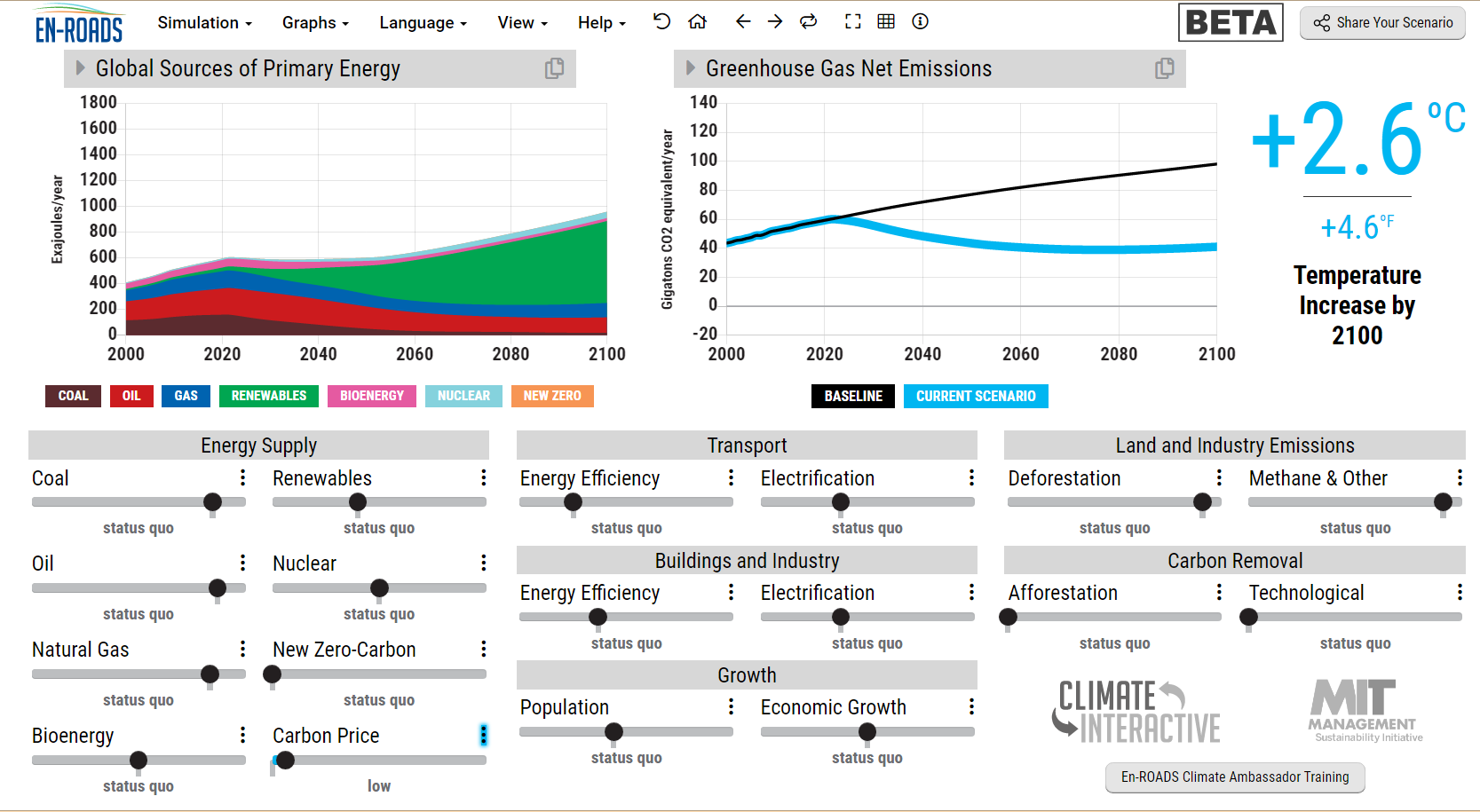

Carbon Pricing Reduces GHGs the Most

- Current projections indicate the planet is on track for a baseline global warming 3.6ºC by 2100.

- Ending fossil fuel subsidies made no material difference: 3.6ºC

- Subsidizing renewables barely budged the global temperature: 3.5ºC

- Subsidizing renewables + aggressively taxing Fossil Fuels: 3.0ºC

- Pricing greenhouse gas (carbon) pollution as per IPCC recommendations: 2.6ºC.

Bottom-line

To de-incentivize the use of fossil fuels we must make the polluter pay – we must put a price on carbon pollution.

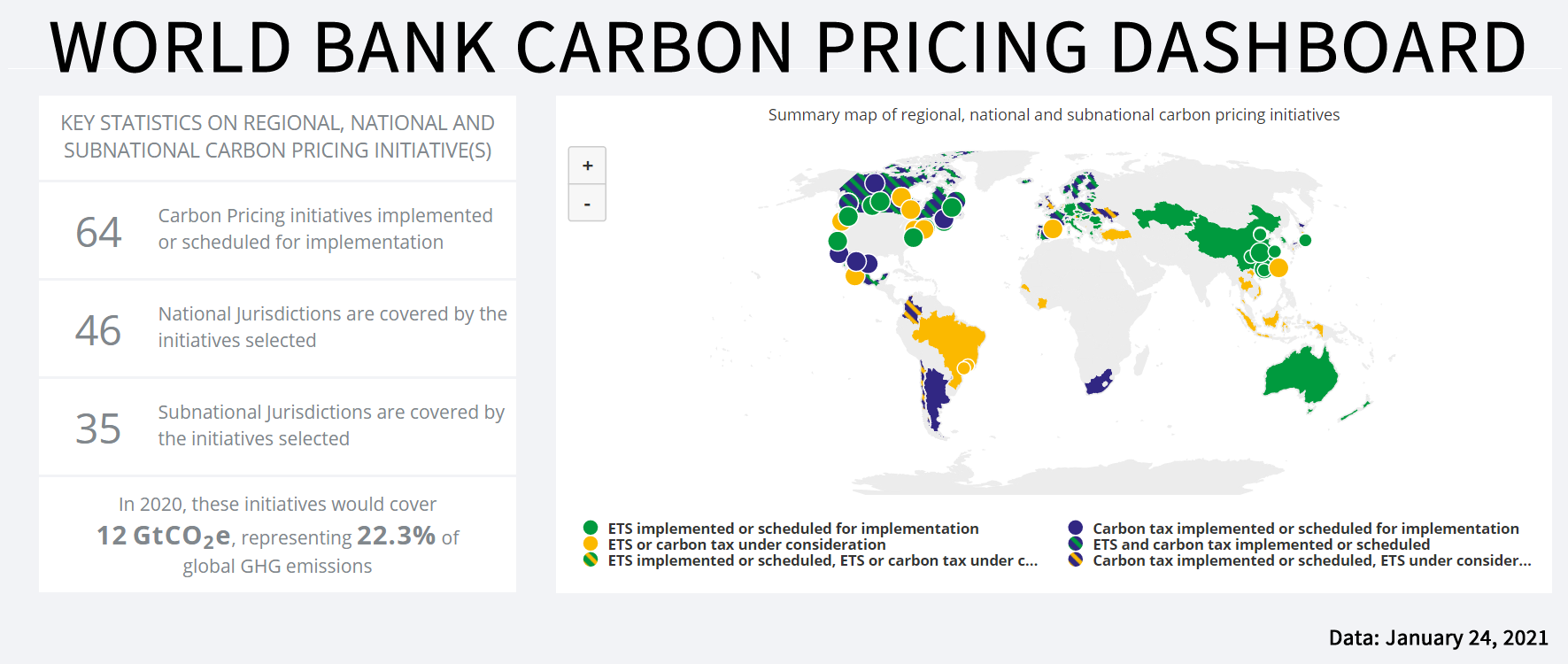

Carbon Pricing Around the World

Around the world, carbon pricing initiatives have been implemented or scheduled for implementation in 64 jurisdictions. In total, there are 46 national initiatives and 35 subnational initiatives. In 2020, these initiatives cover 11 Gt CO2e, representing 20.1% of global GHG emissions. In 2020, these initiatives would cover 12 GtCO2e, representing 22.3% of global GHG emissions. For the most up-to-date information, visit the World Bank’s Carbon Pricing Dashboard.

Additionally, 97 countries have carbon pricing in their commitments to the United Nations. These 97 Parties represent 58 percent of global GHG emissions.

Kryptonite to Fossil Fuel Subsidies

Many governments have proven unable to end fossil fuel subsidies, and have consistently promised to phase out in the timescale of a future government. Carbon pricing can be introduced with less obvious resistance and has been done so in 46 countries with 97 countries including carbon pricing in their commitments to the United Nations. To achieve the 1.5C ambition, it will swamp subsidies within a few short years effectively ending subsidies in the same or less time than currently committed. In addition, it will be necessary to introduce Border Adjustments to protect industry and encourages global adoption of pricing. In summary, effective carbon pricing will lead directly to the end of fossil fuel subsidies.

Positive Impact on Inequality, Food, Health & Women

Once the carbon tax revenue is raised there is a great deal of debate and argument about how the money should be spent.

By returning 100% to citizens as equal monthly payments will avoid the delay and ensure inequality, food, health and women issues are all addressed.

-

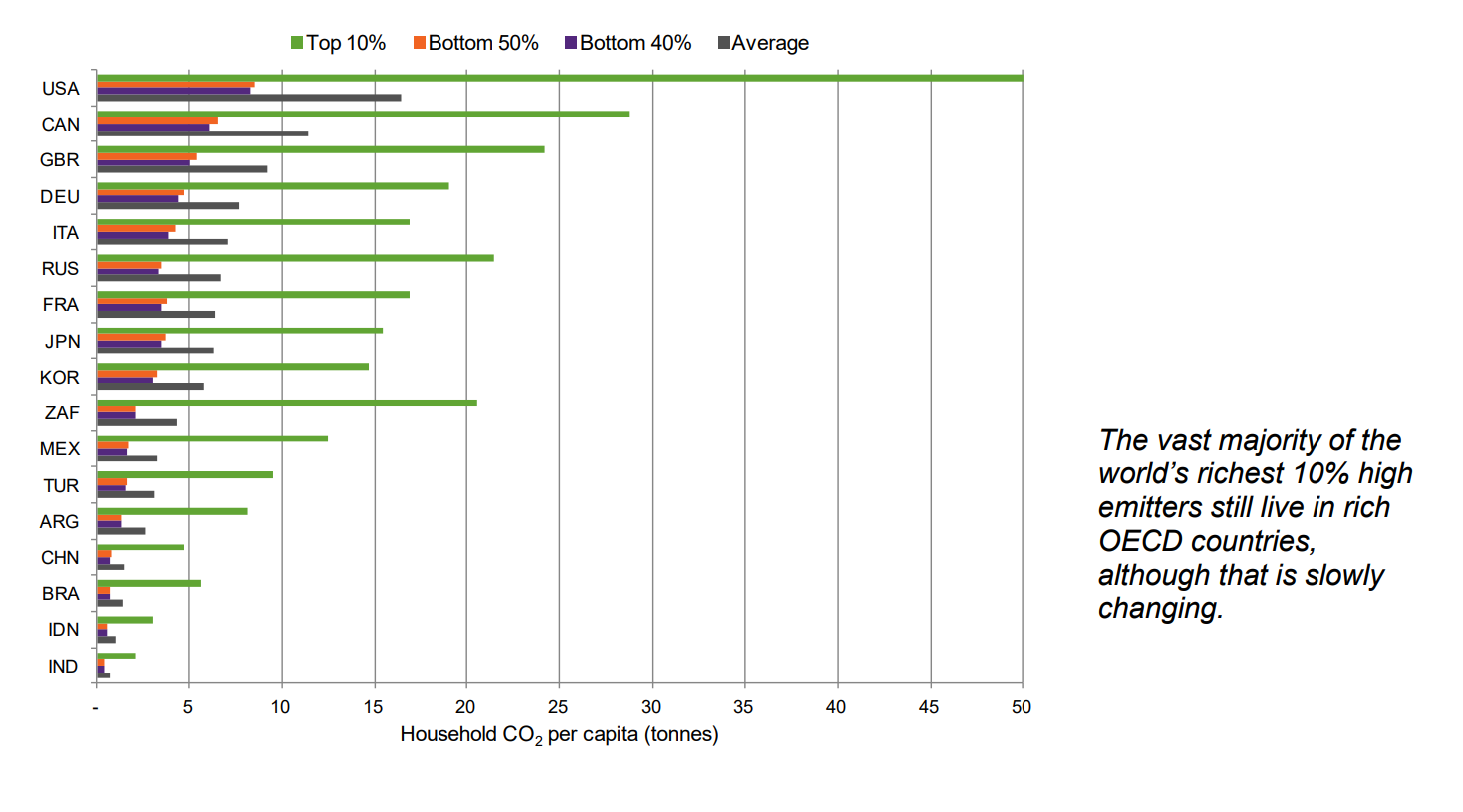

Most poorer families will be better off as their carbon footprints are lower than average. Up to 80% of the population can be better off depending on how much the government recycles and the country. As wealthier families generally consume more, Climate Income directly impacts income inequality.

- Families prioritize the same areas as they have always done: commonly food, health, then leisure and other things. In most families these responsibilities are owned by the leading woman in the household.

Per capita lifestyle consumption emissions in G20 countries for which data is available

From: EXTREME CARBON INEQUALITY Why the Paris climate deal must put the poorest, lowest emitting and most vulnerable people first. Oxfam Briefing, 2015.

Did you know that?

Based on the scientific facts we have 10 years to make a big difference. The solution needs to be evidence-based and clear to everybody: citizens, families, small businesses, industry and the public sector. It also needs to be easy for any government to implement.

Thousands of economists globally, including 28 Nobel Prize Winners, call for a steadily rising carbon price with the dividends given back to the people.