This week, the World Bank Group and International Monetary Fund will hold their Annual Meetings in Marrakech, Morocco. The meetings could be historic—both for consolidating long-term transformation of international financial arrangements and for the immediate impact they may have on some of the most debt-distressed and vulnerable countries. There is hope we will see a rebalancing of development assistance—to better account for climate-related vulnerabilities and to unlock more robust, innovative, cooperative investments in sustainable, inclusive, and resilience-building development.

The World Bank has laid out an Evolution Roadmap:

“centered around the need to become a ‘better and bigger bank’ that is fit-for-purpose to respond to the most pressing needs of people and the planet.”

In April and July, volunteer stakeholder advocates from the CCI network submitted letters to their respective regional or national Executive Directors, outlining a list of principles and priorities for ensuring better outcomes for people in communities. As part of the Evolution Roadmap Consultation Process, CCI submitted a formal list of recommendations, which can be found on our Blue Notes site at cciblue.com/evolving.

We distilled a longer list of asks into four main areas of focus:

- Invest to support the health of all human beings and all of nature.

- Recognize human rights, and don’t punish the vulnerable.

- Support multilateral cooperative arrangements to accelerate integral human development.

- Include stakeholders in design, delivery, and tracking of development finance.

We ask that these reforms align with the PARIS Principles for international cooperation to correct climate-related market failures and with the Principles for Reinventing Prosperity—aimed at fostering an inclusive, sustainable, and resilience-building model of international finance, development, and trade.

All of this is taking place amid an ongoing global debt crisis, in which vulnerable countries see investment depleted, borrowing power erased, and costs and stresses from degraded climate conditions accelerating.

- Just yesterday, Bloomberg reported: “A total of 21 emerging-market nations have sovereign dollar debt trading near distressed levels, as measured by their sovereign dollar bonds trading around a 1,000 basis-point premium…”

- Even in wealthy countries, we are seeing insurers decline to issue new policies or canceling old ones, due to the ever-increasing risk of catastrophic losses due to climate impacts such as fire, flooding, storms, and drought.

- Increasingly, we see economic projections in a climate-stressed world showing significant reductions in GDP, even in wealthy countries, by mid-century.

The IMF Resilience and Sustainability Trust is one year into its work of developing vulnerability-responsive resilience-building investment vehicles to address climate risk and related financial pressures. This allows the IMF to support climate-aligned and vulnerability-sensitive financial arrangements to better serve its unique and critical mission to prevent fiscal failure of nation states, and so to reduce the likelihood of the ensuing social and political destabilization.

It is in this context that the new World Bank evolution plan, to be reviewed by the Development Committee on October 12, re-states the World Bank mission as:

Ending Poverty on a Livable Planet

Given that we organize our mission at CCI around the principle that “A livable future is a human right”, we ask that international financial reforms be conducted in line with the stark scientific findings of the IPCC’s 6th Assessment Report (AR6). Specifically, the report finds that the 1.5ºC threshold is likely to be crossed before 2040. Chapter 4 states:

In the near term (2021–2040), a 1.5°C increase in the 20-year average of GSAT, relative to the average over the period 1850–1900, is very likely to occur in scenario SSP5-8.5, likely to occur in scenarios SSP2-4.5 and SSP3-7.0, and more likely than not to occur in scenarios SSP1-1.9 and SSP1-2.6.

Chapter 4 also finds that overshooting 1.5ºC will make it harder to achieve climate-resilient development, even if the overshoot is partially reversed through carbon drawdown. Chapter 4.6.2 reads, in part:

Overshoot has been found to lead to irreversible changes in thermosteric sea level (Tokarska and Zickfeld, 2015; Palter et al., 2018; Tachiiri et al., 2019), AMOC (Palter et al., 2018), ice sheets, and permafrost carbon (Sections 4.7.2 and 5.4.9) and to long-lasting effects on ocean heat (Tsutsui et al., 2006)

This means critical regulating structures within the climate system may be lost, increasing the prevalence and cost of devastating impacts, and making it harder to restore a livable climate, even if we learn to reabsorb all industrial, agricultural, and transport emissions. In other words, we need to assertively decarbonization plans and pathways that project reaching net-zero at or around 2050.

If most large emitters only reach net-zero in most sectors in 2050, or later, it will likely be impossible to stabilize global heating at 1.5ºC. This means we need to see rapid global realignment of investment priorities across public, private, and multilateral finance, to:

- Replace energy systems that produce global heating pollution with newer competitive technologies that do not;

- Purposefully transition heavy industry, shipping, and infrastructure away from systems that generate global heating pollution;

- Foster cooperative investment in climate-smart food systems that significantly reduce global heating pollution from food loss and waste, and from standard practices in management of land, water, and livestock;

- Explore new multistakeholder financing models—such as a watershed-wide resilience bond—that can benefit municipal budgets, human health, agroecological and regenerative farming efforts, while restoring nature, ecosystems, and biodiversity, all of which reduce or absorb global heating compounds;

- Develop in line with tested standards and mainstream financial priorities the decentralized and more inclusive multi-scale business strategies for getting new technologies and systems to everyone;

- Create new integrated data systems, which materially connect Earth systems science information with financial data and other widely used performance metrics;

- Support the mainstream transformation of finance and economic development with cooperative public policy and trade agreements that align with planetary health and security goals.

Our most recent Blue Note on climate-smart trade recognizes that:

It is the unwritten background insight underlying all international climate policy debate and negotiation that success will mean all trade is climate-smart, along with the everyday economy, everywhere.

Repeating what we wrote in that briefing note, cooperative, contextual innovation must be part of the process of global climate crisis response:

Climate-smart trade—trade that is successful in a climate-stressed world—will require cooperative innovation, cooperative de-risking, and cooperative financial support for innovative endeavors and for critical new services that support sustainable value chains.

Finally, we recognize that none of this will be credible—or ultimately durable enough to carry out multiple simultaneous system-level transformations—without additional layers of oversight and inflows of practical, localized information. The Capital to Communities model of climate finance design and delivery includes stakeholders in the design and implementation of climate-related investments and system-level transformations.

We urge the World Bank Group and the International Monetary Fund to recognize that the rooted, relevant, multidimensional practical information required to succeed in a climate-stressed world will never be complete without direct, robust, and ongoing input from stakeholders and those most vulnerable to shocks or to system failure. Multilateral institutions should explore the creation of financial vehicles that welcome and make use of testimony from those who will live with—and consolidate gains from—climate-related investments.

The hour is far too late to leave any practical insight unattended, and further injustice and exclusion will just lead to waste, cost, and harm, which could have been prevented.

Further Reading

- About Article 6.8 non-market approaches to international climate cooperation

- Consultation on Priorities for a Livable Future

- Distributed multi-scale resilience-building finance is urgently needed

- Earth Diplomacy Leadership Workshops — Register here

- Evolving World Bank mission and practice to support climate-safe integral human development — notes and priorities from CCI

- Food, Finance & Democracy Project

- Good Food Finance Facility — a co-investment platform for food systems transformation

- Integrated Data Systems Initiative — 5-year sprint to deliver mainstream multidimensional metrics

- NDC Collaborative — stakeholder engagement to enhance national climate action strategies

- PARIS Principles to Accelerate Cooperative Climate Resilience

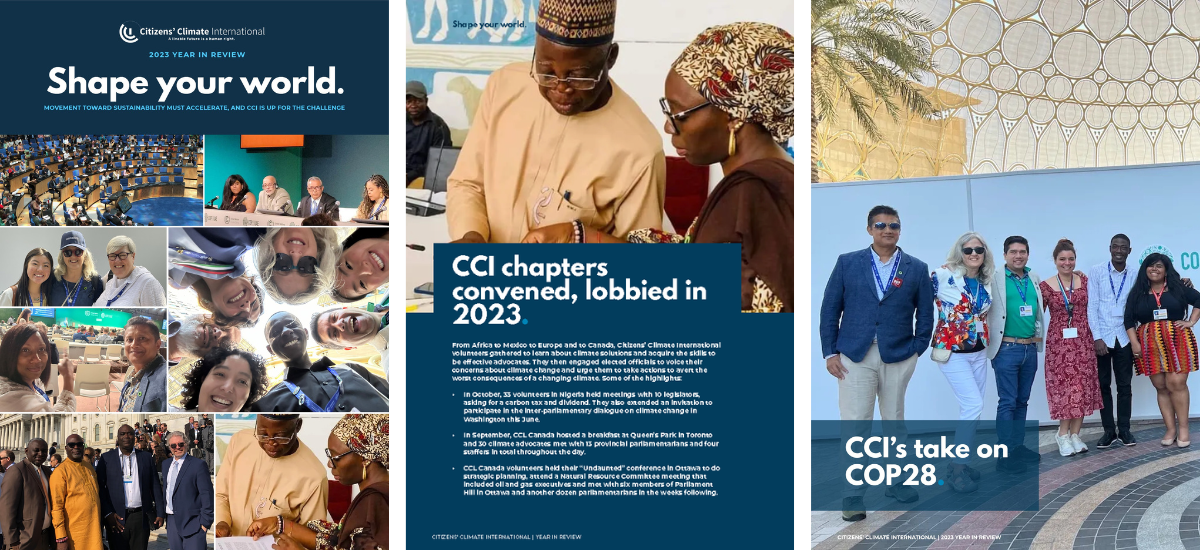

Note: The image at the top shows the negotiating venue for the COP22 United Nations Climate Change negotiations, which took place in November 2016, in Marrakech. The COP22 in Marrakech set in motion the greening of capital markets in Africa, advanced discussions around central bank cooperation to support climate-resilient fiscal policy, and included the launch of the Resilience Intel initiative, a Citizens’ Climate-led effort to create conditions for a transition to 100% climate-smart finance.