This page aims to a be a one stop resource for Climate Income, Carbon Pricing, Carbon Border Adjustment Mechanisms and Redirecting Financial Flows. This resouces on the page are evolving. By the end of May they should be ready for translations.

Workshop Agenda

Agenda

- Welcome

- Learning outcomes

- A video about carbon fee and dividend a.k.a. climate income

- Opening Comments from Joseph Robertson

- Global Cooperation and Climate Interactive’s C-ROADS

- A Climate Kahoot Game for 25 players with discussion

- Review of some the Kahoot answers on Climate Interactive’s EnROADS

- Explore our Climate Income and Redirecting Financial Flows webpage

- Breakout rooms to formulate questions you may have.

- Q&A

- Group Photo

Slides are here but they will not be finalized until Monday, April 8.

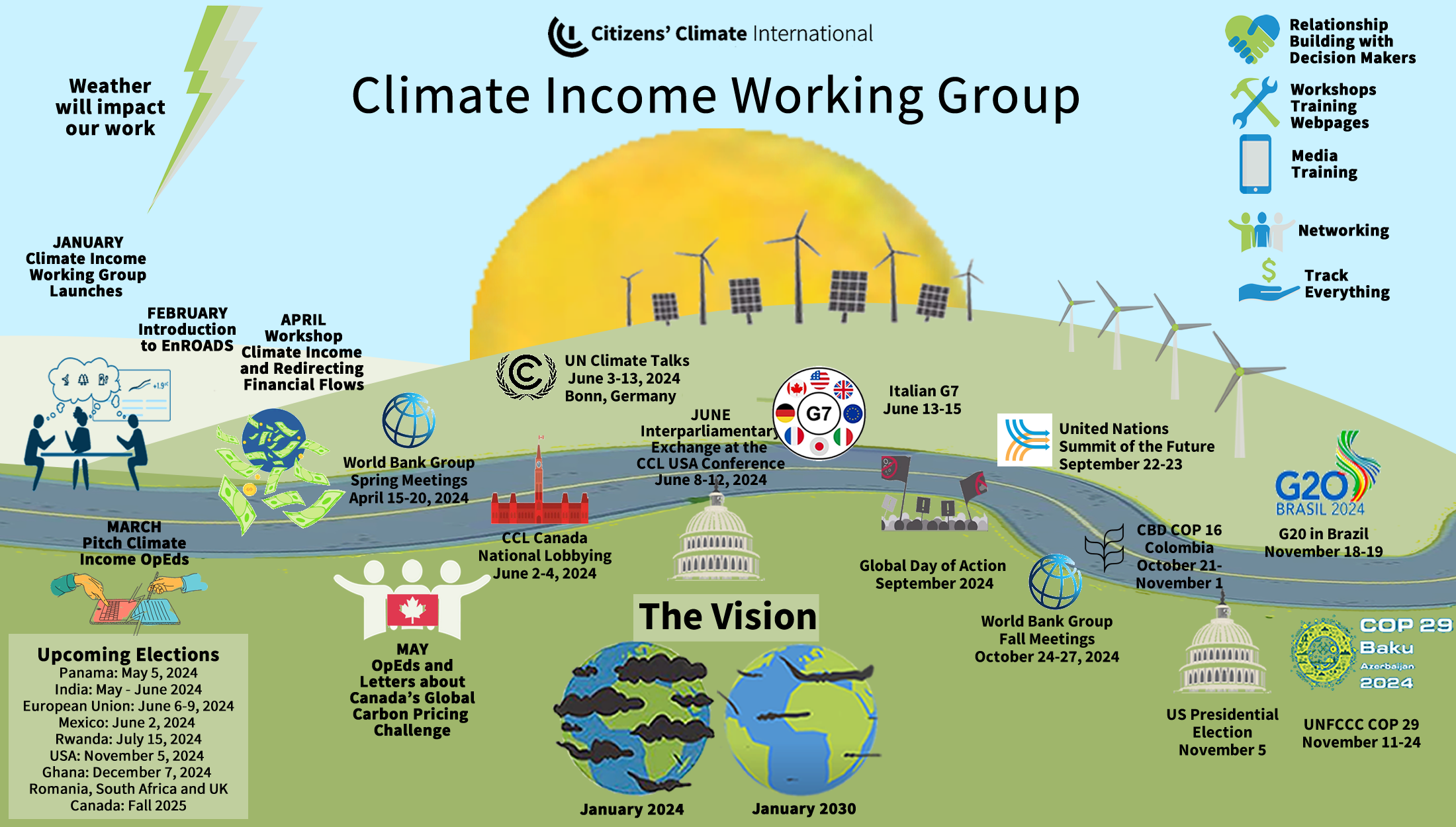

Why now? Fossil fuels contribute to over 85% of the greenhouse gases heating our planet. The encouraging news is that it’s 100% possible to reduce fossil pollution by 45% by 2030 and achieve true net zero in the Global North by 2040 and in the Global South by 2050, all while addressing inequality. This year, it is anticipated that financial flows will finally start to shift away from fossil fuels.

How: By building political will in our home countries and ensuring a chorus of diverse voices at the international negotiations, we can redirect financial flows away from fossil fuels and toward a thriving and equitable planet.

Who: The Climate Income Working Group at Citizens’ Climate International invites climate allies worldwide to join them and explore the fundamentals of carbon pricing, climate income, carbon border adjustment mechanisms, and redirecting financial flows.

Where: The session will take place on Zoom. We also encourage you to gather with groups for collaborative learning.

Key Learning Outcomes: Learn how to discuss climate income, carbon border adjustment mechanisms, carbon pricing and redirecting financial flows in a straightforward manner for both the general public and politicians. You don’t need to become an expert; instead, you’ll become an effective messenger of expert information.

Important: Stay tuned to this page for updates and additional resources. In the meantime register to join one of the workshops.

Laser Talks Booklets

Laser Talks from this event: Laser Talks Booklet to help you with your advocacy. Make a copy and make it your own. You can comment on the booklet but please no wordsmithing. Grammar and spelling corrections and topics for more Laser Talks are all welcome.

Laser Talks in English from CCL France: Five Carbon Pricing Laser Talks

Climate Income - The Basics

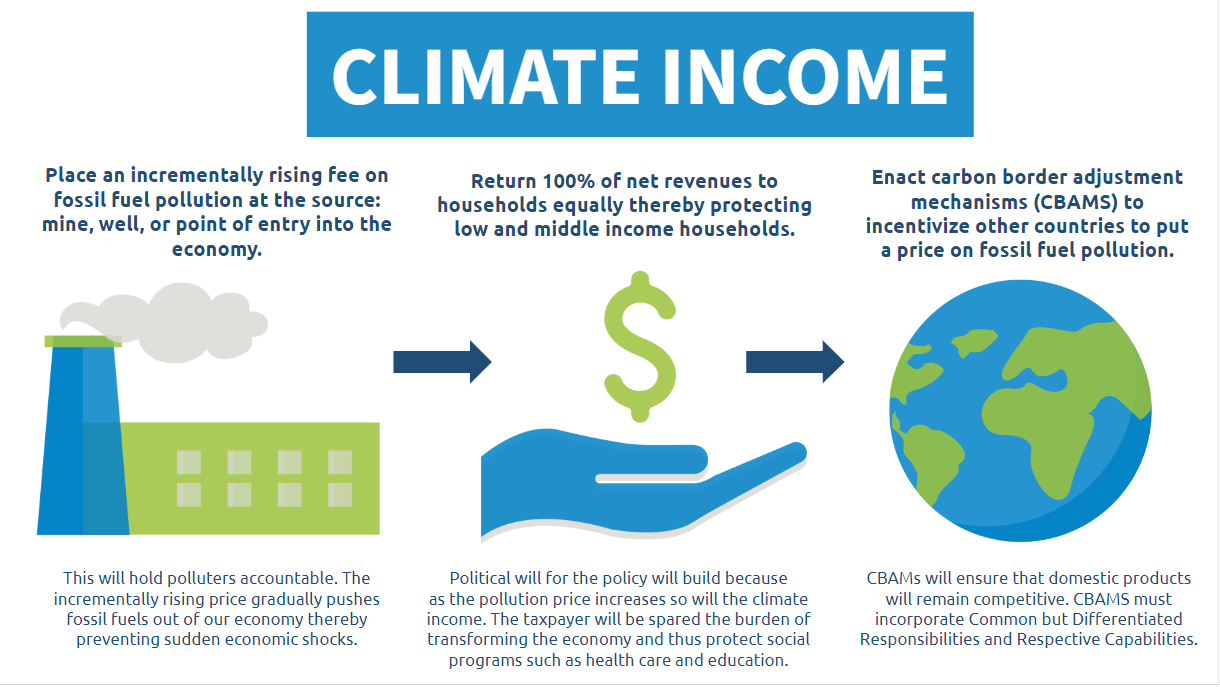

Climate Income is a carbon price that is revenue-neutral (meaning that the revenues do not go to government coffers). It is also known as Carbon Fee and Dividend. It functions as follows:

- A fee is placed on carbon-based fuels at the source (well, mine, or port of entry).

- This fee increases steadily each year so that clean energy is cheaper than fossil fuels within a decade.

- All the money collected is returned to the people on an equitable basis.

- Under this plan, most households would break even or receive more in their dividend than they would pay for the increased cost of energy, thereby protecting the poor and middle class.

- A predictably increasing carbon price will send a clear market signal, which will unleash entrepreneurs and investors in the new clean-energy economy.

- Border carbon adjustments are eventually enacted in partnership with climate-friendly nations to protect vulnerable domestic industries while incentivizing other countries to price carbon.

How Does a Price on Carbon Work? from Citizens’ Climate Education on Vimeo.

Carbon Border Adjustment Mechanisms (CBAMs)

Carbon Border Adjustment Mechanisms (CBAMs )

)

The Climate Income policy has a provision built in to protect trade competitiveness: a “Carbon Border Adjustment Mechanism” (CBAM) imposed on carbon-intensive trade-exposed goods that cross our border in either direction. Products imported from a country that does not bear a carbon price equivalent to ours will have to pay a surcharge to make up the difference. Conversely, a domestic-made product exported to such a country will get a refund for the carbon fee associated with its carbon footprint.

This CBAM prevents domestic manufacturers from being put at a competitive disadvantage in global markets because of the fee. It will also remove the incentive for them to relocate overseas to avoid the carbon fee. In addition, it will encourage foreign countries to adopt their own carbon fee, so they would get the money instead of us. Carbon Fee and Dividend’s CBAM is designed to comply with international trade law.

Two important things to note:

- CBAM applies only to carbon-intensive products, not fuels.

- Considerations of common but differentiated responsibilites must be at the core of all CBAM design.

The Many Ways to Price Carbon Pollution

The climate crisis is a multi-dimensional problem requiring governments to take bold, swift, and coordinated action, and find the optimal mix of both revenue- and spending-based mitigation measures. But they face a policy trilemma between achieving climate goals, fiscal sustainability, and political feasibility.

Our governments have several options for pricing deadly pollution from fossil fuels. They are listed from least transparent to most transparent:

1. The status quo – Our whole society finances fossil fuels – most expensive option by far. The people pay for the damages through taxes, insurance premiums (if they are luck enough to have insurance), impacts on their health and through rising prices on commodities.

2. Subsidizing green energy – Subsidizing green energy uses taxpayer dollars and thus is an implicit carbon tax. It has several problems. It is a distortionary system. The government picks winners and losers. Thus, it can be really hard for investors to predict the future and what will be the best option down the line. As well, unless these subsidizies are directed to low and middle income needs, they will subsidize the energy-intensive habits of the rich. As well, subsidizing clean will barely reduce greenhouse gas emissions because it is does not make polluters pay. Lastly, using taxpayer dollars to transform the economy risks debt crisis and also diverts money away from social programs such as health and educaton.

3. Regulation – Regulation uses taxpayer dollars and thus is also an implicit carbon tax. It requires boots on the ground, eyes on emissions. This approach requires the government to hire regulators to keep tabs on everyone’s emissions and is dependent on the budget for enforcement. This approach is only as effective as the number of sources it can monitor, but hiring regulators is expensive, so it will only catch the largest carbon emitting companies, not your car or your neighbour’s lawnmower or your friend’s boat.

4. Cap and Trade with offsets – creates an artificial market. It involves putting a cap on emissions, but lets companies trade the emissions they produce. It still requires hiring regulators to tell us who is emitting how much (and all the problems that come with regulations) and creates a market where a select few people make money and the rest of us are left with a fluctuating fuel market

5. Carbon Tax a.k.a as Fee and Spend – a sin tax that puts pressure on consumers. The positive is that carbon taxes are highly effective at reducing carbon emissions because they hold companies monetarily accountable for the negative consequences of the emissions they use, and , if the tax is put at the source (such as the coal mine or the oil refinery) they don’t require many regulators. The downside is that, with just a tax on carbon emissions, companies will push the extra cost off to consumers and make all products more expensive. When things get more expensive, people won’t be able to afford as much so it will slow down our GDP growth and economy.

6. Cap and Dividend – Cap and dividend is a market-based trading system which retains the original capping method of cap and trade, but also includes compensation for energy consumers. This compensation is to offset the cost of products produced by companies that raise prices to consumers as a result of this policy.

7. Cap and Spend – Cap and spend is a also market-based trading system which retains the original capping method of cap and trade, but also includes the government taking proceeds and putting them into programs which unless they are highly directed, they can negatively impact the poor and middle class because the rich have a much higher carbon footprint and would benefit much more.

8. Climate Income a.k.a. Carbon Fee and Dividend or Fee and Dividend – This is CCL’s preferred solution. It is simple and effective. Climate Income includes a fee on carbon emissions at the source, then the revenues from that fee go back to households – It’s this dividend that grows the economy and protects the most vulnerable.

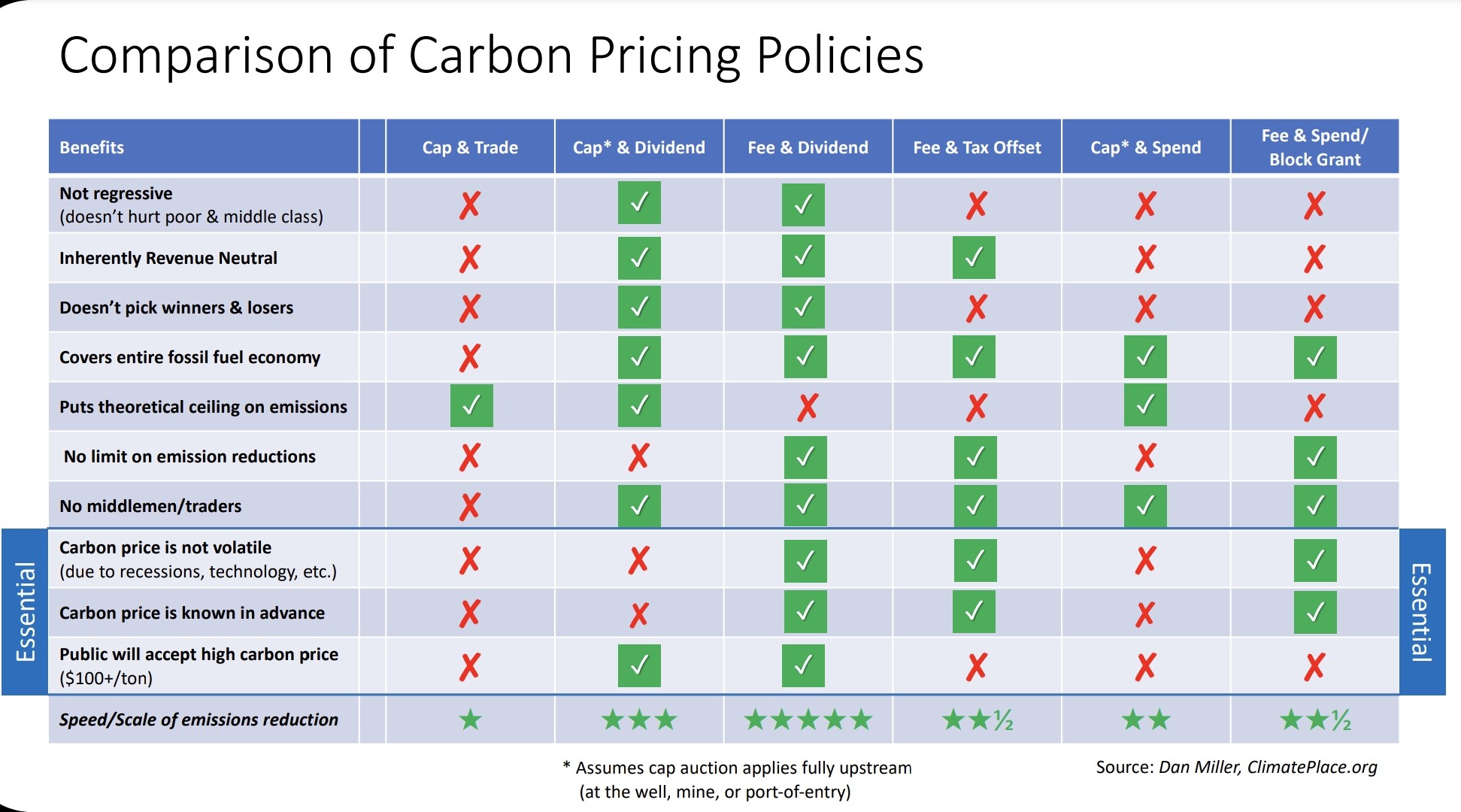

Dan Miller at ClimatePlace.org compiled this very useful chart.

If you want to find out more about him – he has an informative TedTalk too.

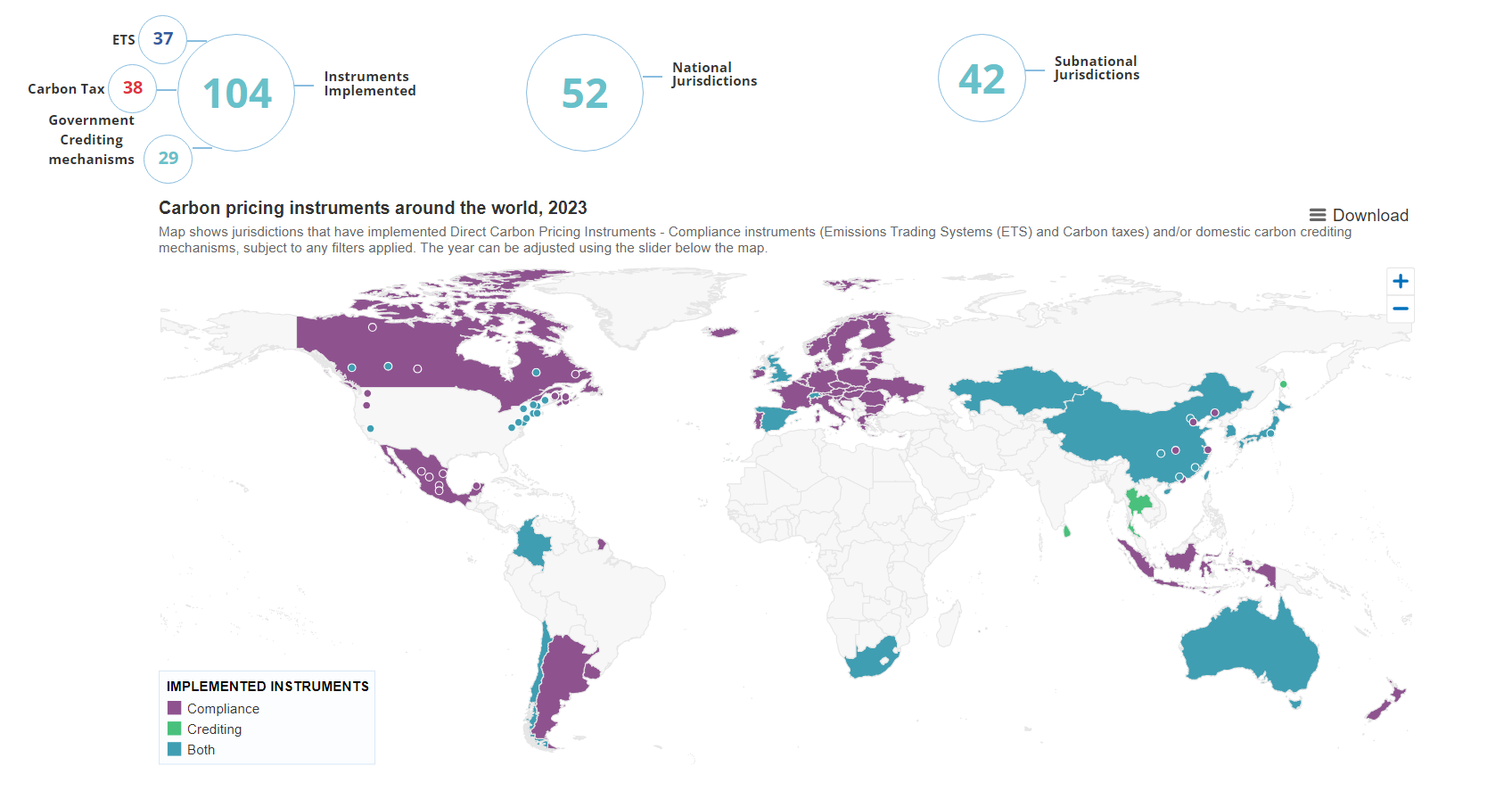

Carbon Pricing Around the World (2023 data)

Image Source: World Bank Carbon Pricing Dashboard

Around the world, carbon pricing initiatives are driving emission reductions that cause climate change. Using data from 142 countries over two decades, researchers found that the average annual growth rate of CO2 emissions from fuel combustion in countries with a carbon price to be 2 percentage points lower compared to countries without a carbon price (Carbon Pricing Efficacy: Cross-Country Evidence, 2020). Further, an additional euro per tonne of CO2 is associated with a reduction in the subsequent annual emissions growth rate of approximately 0.3 percentage points, all else equal.

Carbon pricing initiatives have been implemented or scheduled for implementation in 94 jurisdictions. This includes 52 national initiatives and 42 subnational initiatives. In 2023, these initiatives cover 11.66 GtCO2e, representing 23. % of global GHG emissions. However, only 5% of global emissions currently covered by a carbon price are within the price range needed by 2030. Prices must rise considerably to meet the Paris Agreement temperature goal of 1.5 degrees.

Important initiatives that will drive global carbon pricing:

- In 2021 World Bank, and several countries launched the Partnership for Market Implementation which will assist countries in the Global South in either improving their current carbon pricing or implementing carbon pricing at COP 26 in Glasgow.

- Pakistan announced in March 2024 a carbon tax is under consideration in their country

- On June 6, 2022, Canada and Chile, two countries that have implemented a carbon tax, issued an agreement to accelerate the adoption of carbon pricing around the world.

- On May 16, 2022, Canada and the EU issued a joint declaration confirming the willingness of the EU and Canada to coordinate on respective approaches to carbon pricing and carbon border adjustments to prevent carbon leakage. They also confirmed the intention of the EU and Canada to work together to engage international partners to expand the global coverage of carbon pricing.

- The European Union will enact border carbon adjustments by January 2023 to go into effect in 2026.

For the most up-to-date information, visit the World Bank’s Carbon Pricing Dashboard.

Carbon Pricing Works

Laser Talk: Carbon Pricing Works

Citizens’ Climate International focuses on pollution pricing with rebates because it is widely considered to be the most efficient and least costly way to reduce emissions. That being said, at the end of the day, we are not attached to any one policy, but rather, we are attached to having a livable planet. We are open to effective solutions that are supported by consensus data. As of yet, it’s as simple as this: we have not been shown a better solution.

Major meta-study finds carbon pricing works

A meta-analysis published in May 2024 provides robust evidence that carbon pricing effectively reduces greenhouse gas emissions by 5-21% in the early years of implementation. Analyzing 21 policies, it found significant reductions across various schemes, contradicting previous reviews with unclear methodologies. The effectiveness varies by policy design and context, rather than price level. The study emphasizes the need for more high-quality research, particularly on long-term and high-price schemes, to better understand policy impacts and optimize climate strategies.

1: Systematic review and meta-analysis of ex-post evaluations on the effectiveness of carbon pricing Niklas Döbbeling-Hildebrandt et al Nature Communications (May 16, 2024)

2: Carbon Pricing Works, major meta-study Physics.org (May 16, 2024)

The Economist: Impacts of Carbon Pricing in the EU

In a April 2024 (1) article from The Economist, the European Unions’ carbon pricing policy was lauded as its “biggest climate achievement” due to the fact that sectors covered by this emissions pricing scheme have jointly reduced emissions by 47% compared to when the scheme was first launched.

They state that carbon pricing will cover the lion’s share of the EU’s envisioned 90% emissions reduction for 2040, provided that “politicians have the courage to avoid interfering if higher carbon prices become painful for consumers and industry.”

1: Carbon emissions are dropping—fast—in Europe, Thanks to a price mechanism that actually works. The Economist (April 25, 2024)

IPCC Data

The AR6 IPCC reports acknowledges carbon pricing as an effective lever to reduce emissions: “There is abundant evidence that carbon pricing policies reduce emissions.” 1

Implementing carbon pricing enables low-carbon solutions, like heat pumps, electric vehicles, geothermal energy, renewables, and many more — to develop and scale across the world. However, the report underlines that “while the coverage of emissions trading and carbon taxes has risen, both coverage and price are lower than is needed for deep reductions”. 2

1: IPCC. 2022. AR6 WG3 Chapter 13 Section 13.6.3.3 : Evaluation of Carbon Pricing Experience

2: IPCC. 2022. AR6 WG3 Chapter 13: SPM. https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_Chapter13.pdf

30 Year Longitudinal Data

Using data from 142 countries over two decades, researchers found that the average annual growth rate of CO2 emissions from fuel combustion in countries with a carbon price to be 2 percentage points lower compared to countries without a carbon price.

Further, an additional euro per tonne of CO2 is associated with a reduction in the subsequent annual emissions growth rate of approximately 0.3 percentage points, all else equal.

Source: Carbon Pricing Efficacy: Cross-Country Evidence (2020)

Pembina Study on Carbon Tax in B.C.

In an independent study (1) from the Pembina Institute, it was found that B.C.’s provincial carbon tax had the following impact on emissions within the province:

“Looking economy-wide, recent analysis shows per capita fossil fuel use declined by 16.1 per cent in B.C. from 2008 through 2013. The same metric has risen by over three per cent in the rest of Canada. During this same period, B.C.’s per capita GDP has slightly outpaced the rest of Canada’s, growing by 1.75 per cent versus 1.28 per cent.”

1: lessons-bc-carbon-tax-112014.pdf (pembina.org)

Independent Assessment of Canadian Climate Policies

The Climate Institute, in their analysis of Canada’s current climate policies (1) found that with the maintenance of the carbon price in large-emitter programs and with the implementation of policy for heavy transport and buildings, it would be enough to “put Canada on a path for net emissions of 482 MtCO2e in 2030, or a 34 per cent reduction below 2005 levels.“

Risk of Debt Crisis

The International Monetary Fund (IMF) warned (1) in October 2023 that relying solely on subsidies to transform our energy systems could increase debt relative to GDP, potentially leading to a debt crisis.

1: IMF warns of climate-linked debt crisis | IFR (ifre.com)

Expert Endorsements

The pollution fees with rebates approach has garnered widespread support from thousands of professional economists (1) worldwide, including 28 Nobel laureates (2) and over 400 Canadian Economists (3), who recognize the efficacy of carbon pricing in driving emissions reductions.

1: Economists’ Statement on Carbon Pricing – EAERE

2: Economists’ Statement on Carbon Dividends Organized by the Climate Leadership Council

3: An Open Letter from Economists on Canadian Carbon Pricing | Ecofiscal

Economist Dr. David Robinson

Dr. David Robinson said this about fossil fuel pollution pricing with rebates, “It is actually the best scheme in the world anyone has come up with.”

Economist Dr. Chris Ragan

Dr, Chris Ragan recently said this, “The carbon tax and rebate is, in my view and the view of the 425 economists who have signed that open letter, not just *a* way to reduce greenhouse gas emissions in Canada, but it is the *lowest cost* way.”

Critics are right – but…

Some critics say that carbon pricing is not necessary for hitting our climate targets, and they are right. Countries could abandon carbon pricing and still hit their climate targets by using other types of regulations and subsidies—but it would be much more costly to do so. To truly know if there is a better option, we must be shown the costs and GHGs reductions of alternative plans. Otherwise, it is not a true solution..

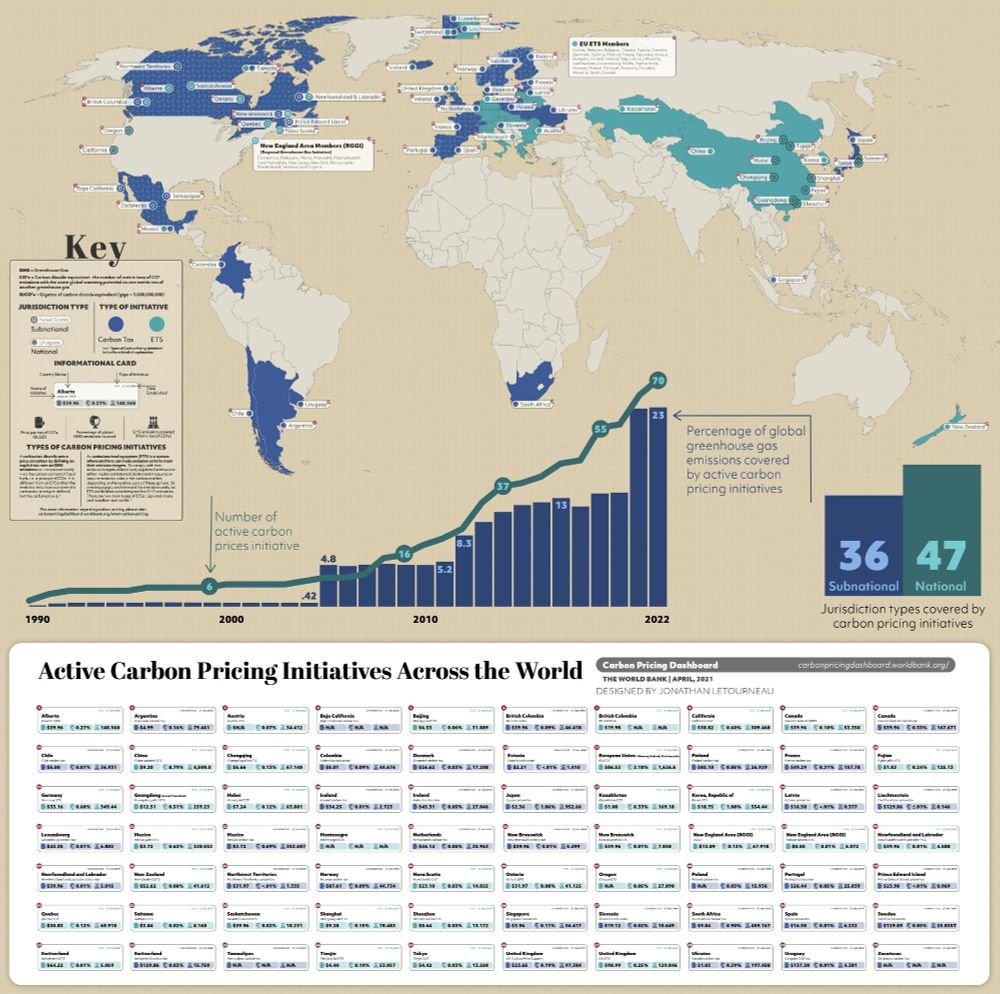

Carbon Pricing and the Visual Capitalist

Global Carbon Pricing and the Visual Capitalist

We particularly find this visual compelling and informative. Note the data is from 2022.

Climate Income Reduces Inequality and GHGs

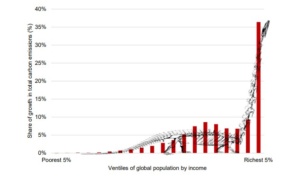

The Carbon Inequality Brontosaurus Chart

In September 2020, the Stockholm Environment Institute released an insightful report (1). In the 25 years from 1990 to 2015, annual global carbon emissions grew by 60%, approximately doubling total global cumulative emissions.

The disproportionate impact of the world’s richest people is unmistakable and the chart looks like a brontosaurus – with a tall neck and long tail.

The disproportionate impact of the world’s richest people is unmistakable and the chart looks like a brontosaurus – with a tall neck and long tail.

The “tall neck” is the result of the fact that nearly half of the total growth in absolute emissions was due to the richest 10%, with the richest 5% alone contributing over a third (37%). The emissions linked to the top 1% alone grew more than three times as much as those linked to the bottom 50%.

The bottom 50% comprises the “long tail”. Since the bottom 50% has 50 times more people in it, the average per capita consumption emissions linked to the top 1% in 2015 were over 100 times greater than the average per capita consumption emissions of the poorest half of the world’s population.

The global carbon budget is a precious natural resource. These results suggest a need for increased attention to be paid to the ongoing porcine impact of the small minority of the world’s richest citizens and the enormous and continuing economic development needs of the world’s poorest citizens.

Our socio-economic and climate policies most certainly can be designed to address carbon inequality. In fact, Canada’s climate income policy (2) addresses the “brontosaurus in the room”(3) (4).

References:

(1) The Carbon Inequality Era | SEI (2020)

(2) The Greenhouse Gas Pollution Pricing Act (2018)

(3) Fiscal and Distributional Analysis of the Federal Carbon Pricing System (2019)

(4) Beyond Paris: Reducing Canada’s GHG Emissions by 2030 (2021)

Pollution pricing with equal dividends enhances equity and development

In a November 2021 peer-reviewed paper in Nature, researchers reported that a global 2C temperature* can be met while also increasing well-being, reducing inequality and alleviating poverty, if each country or region imposes a substantial carbon tax and refunds the revenues to its citizens on an equal per capita basis. When revenues are not used in such a progressive way, the model also verified that many of the poorest citizens are negatively impacted in the short-to-medium term. These results indicate that it is possible for a society to implement strong climate action without compromising goals for equity and development.

*With a few more policies in play we can achieve the 1.5C goal too.

————————————————————————————————————————

Carbon Inequality in the G20 Nations

In December 2015 at the Paris Agreement, Oxfam presented their paper on Extreme Carbon Inequality.

As one can see in the graph below in G20 countries for which they had data, the per capita GHG emissions for the richest top 10% of households in every country were well above average. Whereas on the flip side, the bottom 50% and bottom 40% of households’ GHG emissions were below average. This explains why the carbon pricing program of climate income where we have data (USA, Australia, and Canada) on average at least ⅔ of households come out ahead.

Most countries have similar income distributions. You can use Wolfram Alpha to determine your country’s income distribution pattern and Gini Index relative to Australia, Canada, and the USA and then infer that the results would be anticipated to be similar.

Key Conclusions of IPCC AR Synthesis Report (March 2023)

Conclusions of the IPCC AR6 Synthesis Report

On Monday, March 20, 2023, in Interlaken, Switzerland, the IPCC released its final assessment report in its sixth cycle (AR6) – the Synthesis report. Here are some of the key conclusions from that report.

At that time, United Nations Secretary-General António Guterres announced a plan to massively fast-track climate action. He has proposed a G-20 Climate Solidarity Pact that includes an Acceleration Agenda which calls for:

- an end to coal, net-zero electricity generation by 2035 for all developed countries and 2040 for the rest of the world,

- a stop to all licensing or funding of new oil and gas, and any expansion of existing oil and gas reserves.

- GHG needs to go down now and be cut by almost half by 2030.

There was a revisions in the net-zero goals for developed nations to reach net-zero by 2040 whereas developing nations should achieve that goal by 2050. The good news is that it is achievable.

The report finds that the economic benefits for people’s health from air quality improvements alone would be roughly the same, or possibly even larger than the costs of reducing or avoiding emissions. To be effective, these choices need to be rooted in our diverse values, worldviews, and knowledge, including scientific knowledge, Indigenous Knowledge, and local knowledge.

Increasing finance to climate investments is important to achieve global climate goals. The synthesis report is quite clear that there is sufficient global capital to rapidly reduce greenhouse gas pollution if existing barriers are reduced. Global capital is all the savings held by banks, pensions, financial institutions, governments, and individuals. Governments, through public funding and clear signals to investors, are key in reducing these barriers.

Policies such as an incrementally rising price on carbon pollution pricing with equal dividends to households, carbon border adjustment mechanisms, reforms at the World Bank, and climate risk disclosure rules for financial institutions would provide clear signals to redirect financial flows away from fossil fuels while not burdening the taxpayer.

Investors, central banks, and financial regulators must play their part. That is because much of the trillions of dollars of financing for fossil fuels come from the private sector. Thus, redirecting private sector finance away from fossil fuels is key.

One of the key conditions for enabling a liveable future is inclusive governance. Our mothership, Citizens’ Climate Education has been training volunteers to build healthy relationships with their parliamentarians and community since 2007.

Transforming the Economy

Takeaway: Governments must enact specific policies that will redirect financial flows to ensure our planet’s continued prosperity.

Full version: Humanity has crossed 6 of the 9 planetary boundaries necessary for our continued survival on this planet. Crossing these boundaries increases the risk of generating large-scale abrupt or irreversible environmental changes.

Unfortunately, our current economic system sacrifices nature and human health for quick economic gains. We need to change this harmful way of thinking, and we can do it.

The path forward is clear. We must redirect financial flows towards a thriving and equitable planet.

Governments must swiftly enact subsidy and tax reforms, ensure polluters pay for greenhouse gas emissions, and reform financial systems to cease supporting fossil fuel projects. These policies must align with the science of a 1.5°C planet, requiring a 45% reduction in greenhouse gases by 2030 and true net-zero by 2040. Citizen engagement as well as all human rights must be embedded into the ongoing development of all policies.

This won’t be simple, but we’ll need everyone around the world to work together to make this happen.

Here is a link Canva Images that you customize to your own needs.

Seven International Coalitions of Interest

At the UNFCCC COPs, countries meet and form alliances. Here are seven coalitions of interest for those interested in carbon pricing and transitioning away from fossil fuels. Click in the links and find out if your country are members of this coalition.

- The Carbon Pricing Leadership Coalition

The Carbon Pricing Leadership Coalition brings together leaders from government, private sector, academia, and civil society to expand the use of carbon pricing policies. - Canada’s Carbon Pricing Challenge

The Global Carbon Pricing Challenge (GCPC) was announced by Canada during COP26. Since then, the GCPC has grown into an international initiative, steered by a growing number of Partner and Friend jurisdictions. - The Beyond Oil and Gas Alliance:

The Beyond Oil and Gas Alliance (BOGA) is an international alliance of governments and stakeholders working together to facilitate the managed phase-out of oil and gas production. Launched by the governments of Denmark and Costa Rica, the alliance aims to elevate the issue of oil and gas production phase-out in international climate dialogues, mobilize action and commitments, and create an international community of practice on this issue. The alliance is currently co-chaired by the governments of Denmark and Quebec. - The Fossil Fuel Non-Proliferation Treaty:

The Fossil Fuel Non-Proliferation Treaty Initiative is a global effort to foster international cooperation to accelerate a transition to renewable energy for everyone, end the expansion of coal, oil and gas, and equitably phase out existing production in keeping with what science shows is needed to address the climate crisis. - The Powering Past Coal Alliance

In 2017, the PPCA was launched by the British and Canadian governments at COP23. Since then, it’s grown rapidly from 27 initial members to over 182. Through working with its members and partners, the PPCA aims to accelerate the transition away from coal power by helping set ambitious phase-out dates, sharing best practice, and unlocking international finance. - Joint taskforce on international taxation launched at COP28

On December 2, 2023, during the opening days of COP28, Antigua and Barbuda, Barbados, France, Kenya, Spain, and the African Union Commission, with the European Commission as an observer, jointly launched a new taskforce on international taxation. The taskforce is planned to analyze various taxation options, such as a global carbon tax regime, a carbon tax on the fossil fuel trade, shipping, and aviation, as well as a global Financial Transaction Tax. The members of the coalition mobilized around the taskforce stated their openness to cooperation with other countries and CSOs. The taskforce will be supported by the European Climate Foundation.

- The Coalition of Finance Ministers for Climate Action

The Coalition of Finance Ministers for Climate Action brings together fiscal and economic policymakers from over 90 countries in leading the global climate response and in securing a just transition towards low-carbon resilient development.CANVA FOR THE INTERNATIONAL COALITIONS LASER TALK

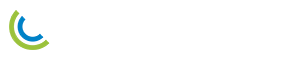

Climate Action is Matter of Fiscal Responsibility

Climate Action is a Matter of Fiscal Responsibility

By 2050, global annual damages are estimated to be around $38 trillion, with a likely range of $19-59 trillion by 2050.

Researchers have found that even with drastic cuts to CO2 emissions starting today, the world economy is already set to lose 19% of its income by 2050 due to climate change. The damages, estimated to be six times larger than the costs of limiting global warming to two degrees, were calculated using empirical data from over 1,600 regions worldwide over the past 40 years.

These figures primarily result from rising temperatures and changes in rainfall and temperature variability, and could be even higher when accounting for other weather extremes like storms and wildfires.

If emissions are not drastically and immediately reduced, economic losses could reach up to 60% on global average by 2100, clearly demonstrating that protecting the climate is much cheaper than not doing so.

The study also highlights the considerable inequity of climate impacts, with countries in the tropics suffering the most due to their already warmer climates. The countries least responsible for climate change are predicted to suffer income losses 60% greater than higher-income countries and 40% greater than higher-emission countries, despite having the least resources to adapt to the impacts.

“It is on us to decide: structural change towards a renewable energy system is needed for our security and will save us money. Staying on the path we are currently on, will lead to catastrophic consequences. The temperature of the planet can only be stabilized if we stop burning oil, gas and coal,” says Anders Levermann, Head of Research Department Complexity Science at PIK and co-author of the study.

References

Climate Change to Cost Global Economy 19% by 2050, Study Finds – ScienceBlog.com

The economic commitment of climate change – Nature

The FASTER Principles

The Carbon Pricing Leadership Coalition officially launched at the 2015 UNFCCC COP in Paris (1). Citizens’ Climate Lobby joined the Carbon Pricing Leadership Coalition in September 2015. Carbon Pricing Leadership partners all agree the world needs to price carbon fairly, effectively and efficiently, as soon as possible (2).

As part of the Carbon Pricing Leadership Coalition, the World Bank and the Organisation for Economic Development (OECD) released a report outlining proposed carbon pricing principles that are crucial for success to decarbonize the world economy by 2100 (3) and how the world can get there “FASTER”.

FASTER Principles include the following elements:

– A steadily intensifying price signal,

– Upstream pricing,

– Administrative simplicity,

– Fiscal dividend.

The FASTER Principles are an acronym for:

– Fairness

– Alignment of policies and objectives

– Stability and predictability

– Transparency

– Efficiency and cost-effectiveness

– Reliability and environmental integrity

(1) Carbon Pricing Leadership Coalition Official Launch Carbon Pricing Leadership Coalition (November 2015)

(2) Carbon Pricing Leadership – The First Success at COP 21 CarbonPricing Leadership Coalition (December 15, 2015)

(3) FASTER PRINCIPALS World Bank (October 2015)

The Paris Principles (Our work pre-Paris Agreement)

As the world moved toward the 2015 Paris Climate Agreement, it became evident nations were going to need to find a way to structurally transform incentives across their economies, and they would need a way to do this while innovating collaboratively. Our team was working, at the time, on a way to communicate the virtues of a people-centered approach to carbon pricing, that would allow nations to use the same language, think towards the same goals, and explore diverse suites of policies best suited to their needs and priorities.

That work led to the PARIS Principles for effective, efficient, equitable carbon pricing:

- Price pollution with a defined, steadily rising price on climate-disrupting emissions, preferably at the source.

- Add momentum. Enhance incomes; build economic value at the human scale.

- Reduce emissions effectively and accountably, by keeping the administrative structure simple and transparent.

- Internalize inefficiencies—cost and harm linked to polluting business models—incrementally, with escalating certainty and with no leakage.

- Spread by aligning price signals and supporting policies, harmonizing across borders, so pricing can be enacted country by country.

In other words, put a price on pollution to:

- Add good and reduce bad, while…

- Internalizing costs and spreading benefits.

United Nations High Level Group Report: Integrity Matters

UN’s Integrity Matters and High-Level Expert Group on Net-Zero Commitments

Takeaway: At COP 27 in Egypt the UN High-Level Expert Group on net-zero commitments (HLEG) launched its report Integrity matters: Net zero commitments by businesses, financial institutions, cities and regions. The goal of the group was to develop stronger and clearer standards for net-zero emissions pledges by non-State entities.

- Technologies must come as advertised

- There are limits on the use of carbon offsets

- No new fossil fuel infrastructure

- Plan for unwinding from fossil fuels

- No being aligned with groups that lobby for fossil fuels

- Investments must be made in a just-transition.

Full Version: At COP 27 in Egypt the UN High-Level Expert Group on net-zero commitments (HLEG) launched its report Integrity matters: Net zero commitments by businesses, financial institutions, cities and regions. The goal of the group was to develop stronger and clearer standards for net-zero emissions pledges by non-State entities. The group was led by the Honourable Catherine McKenna, Canada’s former Minister for the Environment and Climate Change.

Secretary-General António Guterres said: “A growing number of governments and non-state actors are pledging to be carbon-free and obviously that’s good news. The problem is that the criteria and benchmarks for these net-zero commitments have varying levels of rigour and loopholes wide enough to drive a diesel truck through. We must have zero tolerance for net-zero greenwashing.”

The Integrity Matters resource aims to develop stronger and clearer standards for net-zero emissions pledges by non-state entities and speed up their implementation. The report provides clarity in four key areas – environmental integrity, credibility, accountability and the role of governments. The report is organized under five principles and ten recommendations.

Five principles:

- Ambition which delivers significant near— and medium —term emissions reductions on a path to global net zero carbon dioxide emissions by 2050 and net zero greenhouse gas emissions soon after

- Demonstrated integrity by aligning commitments with actions and investments

- Radical transparency in sharing relevant, non-competitive, comparable data on plans and progress

- Established credibility through plans based in science and third-party accountability

- Demonstrable commitment to both equity and justice in all actions

Ten Recommendations::

- Announcing a Net Zero Pledge

- Setting Net Zero Targets

- Using Voluntary Credits

- Creating a Transition Plan

- Phasing out of Fossil Fuels and Scaling Up Renewable Energy

- Aligning Lobbying and Advocacy

- People and Nature in the Just Transition

- Increasing Transparency and Accountability

- Investing in Just Transitions

- Accelerating the Road to Regulation

More information: On Valentine’s Day, the Honourable Catherine McKenna joined Citizens’ Climate International for a fireside chat. A considerable chunk of that conversation centered around the UN’s Integrity Matters report. You can watch it:

Renewable Energy and Storage are Unstoppable

Laser Talk: Renewable Energy and Storage are Unstoppable

Renewable energy adoption is surging globally, with 7 countries already generating 100% of their electricity from renewable sources, while 40 others produce over 50% from renewables, including 11 European nations. Solar energy, driven by efficiency gains and cost reductions, is poised to become the primary global energy source by 2050 (1). The fact is new renewable energy is cheaper than new fossil energy. (2)

California leads in battery storage, boasting 10,000 MW installed, second only to China (3). The state is making strides toward achieving 24/7 renewable energy, with the grid operating on 100% renewables for parts of the day throughout March and April. (4)

Increasing the price on pollution from fossil fuels (with rebates) enables clean solutions to develop to scale. This will speed up the transformation that is already underway without burdening the taxpayer.

References

- Seven countries now generate 100% of their electricity from renewable energy (The Independent) April 2024 https://bit.ly/4dcmaci

- Renewable Power Remains Cost-Competitive amid Fossil Fuel Crisis (IRENA):

https://www.irena.org/news/pressreleases/2022/Jul/Renewable-Power-Remains-Cost-Competitive-amid-Fossil-Fuel-Crisis - Check out California’s batteries (Politico) April 2024

https://www.politico.com/newsletters/california-climate/2024/04/25/check-out-californias-batteries-00154503 - Follow Mark Jacobson on Twitter

Effective Climate Communications

If you really want to empower people and help save the planet and not be part of the cynicism and doomerism loop with your communications, the data is clear: people respond best to short stories that follow this consistent pattern: problem, pathway, and then benefits. State the problem. Describe the path to get there. Outline the benefits.

Basically talk like a human.

The 4 most relevant articles in the Paris Agreement for our work?

The four most relevant articles in the Paris Agreement to our work are:

- Article 6.8

Parties recognize the importance of integrated, holistic and balanced non-market approaches being available to Parties to assist in the implementation of their nationally determined contributions, in the context of sustainable development and poverty eradication, in a coordinated and effective manner, including through, inter alia, mitigation, adaptation, finance, technology transfer and capacity-building, as appropriate. These approaches shall aim to:

(a) Promote mitigation and adaptation ambition;

(b) Enhance public and private sector participation in the implementation of nationally determined contributions; and

(c) Enable opportunities for coordination across instruments and relevant institutional arrangements.World Bank Reforms, Climate Income and Carbon Border Adjustemnt Mechanisms are captured under Article 6.8. - Article 2.1C

This Agreement, in enhancing the implementation of the Convention, including its objective, aims to strengthen the global response to the threat of climate change, in the context of sustainable development and efforts to eradicate poverty, including by:

… Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development. - Article 7.1

Parties hereby establish the global goal on adaptation of enhancing adaptive capacity, strengthening resilience and reducing vulnerability to climate change, with a view to contributing to sustainable development and ensuring an adequate adaptation response in the context of the temperature goal referred to in Article 2. - Article 12

Parties shall cooperate in taking measures, as appropriate, to enhance climate change education, training, public awareness, public participation and public access to information, recognizing the importance of these steps with respect to enhancing actions under this Agreement.

Most of our work does not involve carbon credits and offsets and thus, Article 6.2 and 6.4 of the Paris Agreement are less relevant to our work.

What are the Climate Value Exchange and Resilience Intelligence?

The Climate Value Exchange is relevant for the diplomatic work at CCI and is not something our grassroots volunteers need to concern themselves about. It was established, in January 2024, to support the better, more detailed, more forward-thinking elaboration of non-market approaches to building an everyday economy that consistently delivers climate value, rather than wastefully exacerbating climate breakdown.

The CCI Resilience Intelligence Program is focused on substantive support for the Resilience Intel climate-smart finance initiative. It is relevant to our thinktank work and it is also something our grassroots volunteers need to concern themselves about.

However, for volunteers wishing to become effective at international negotiations, they should start familiarizing themselves with this work and seek climate diplomacy training.

The Fossil Fuel Industry has Funded Climate Disinformation for Decades

The Fossil Fuel Industry Funded Climate Disinformation for Decades

Even to this day, there are individuals who deny or downplay the link between the burning of fossil fuels and the impacts that pollution has on our climate and health. How did this happen?

Key players in the fossil fuel industry knew decades ago that burning coal, oil, and methane gas to warm our homes, power our cars, and generate electricity was warming the planet. Instead of acting on the knowledge, they began financing a massive disinformation campaign. Now, as a consequence, youth are having to fight for their inalienable right to have a safe and liveable future.

Happily, when you inform people that the fossil fuel industry funded a climate disinformation campaign for decades, people are more likely to believe you when you present solutions.

It is not going unnoticed too. A quarter of all US Americans live in jurisdictions that are suing big oil over lying to the public.

Suggested readings:

- Climate Cover-Up (2009) By James Hoggan and Richard Littlemore

- Merchants of Doubt: How a Handful of Scientists Obscured the Truth on Issues from Tobacco Smoke to Climate Change (2011) by Naomi Oreskes and Erik Conway

- Oil’s Deep State: How the petroleum industry undermines democracy and stops action on global warming – in Alberta, and in Ottawa (2017) Dr. Kevin Taft

- The New Climate War: The Fight to Take Back Our Planet (2021) By Michael E. Mann

- The Petroleum Papers: Inside the Far-Right Conspiracy to Cover Up Climate Change (2022) By Geoff Dembecki

- Fire Weather (2023) By John Vaillant

We are not as a polarized as we think

We Are Not As Polarized As We Think

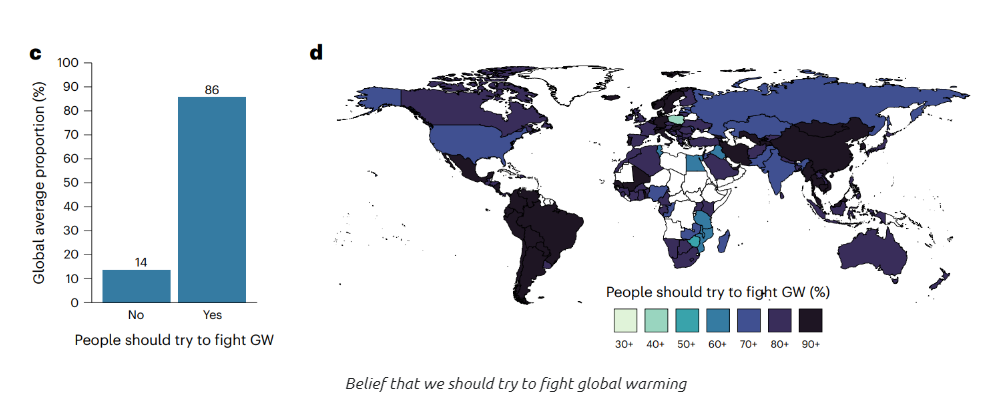

In a nutshell: The polarization of our media and political spaces may lead some to believe that climate action is unpopular, but a recent study published in Nature shows that about two-thirds of the global population are willing to incur a personal cost to fight climate change, and the overwhelming majority demands political action on climate.

Climate scientists have stressed that immediate, concerted and determined action against climate change is necessary. But how willing are people to actually follow this advice?

A recent study published in Nature (1) shows that 69% of the global population report being willing to incur a personal cost to fight climate change, 86% endorse pro-climate social norms, and 89% demand intensified political action.

This indicates that the world is united in its understanding of what must be done to address climate change and the need to act. However, despite these encouraging statistics, the world is also in a state of global pessimism, wherein individuals around the globe systematically underestimate the willingness of their fellow citizens to act.

Why might this be? The study pins down, among others, the following reasons:

- Media and public debates disproportionately emphasizing climate-sceptical minority opinions (2)

- The influence of interest groups’ campaigning efforts (3)

- Erroneously attributing the inadequate progress in addressing climate change to a persistent lack of individual support for climate-friendly actions (4)

This is dangerous for climate action because it can dissuade and demotivate climate advocacy.

There is, however, a cure: a concerted political and communicative effort to correct these misperceptions. Starting with you and me!

References:

- Globally representative evidence on the actual and perceived support for climate action https://www.nature.com/articles/s41558-024-01925-3

- Balance as bias: global warming and the US prestige press – ScienceDirect

https://www.sciencedirect.com/science/article/abs/pii/S0959378003000669?via%3Dihub - Oreskes, N. & Conway, E. M. Merchants of Doubt: How a Handful of Scientists Obscured the Truth on Issues from Tobacco Smoke to Global Warming

- The Intuitive Psychologist And His Shortcomings: Distortions in the Attribution Process – ScienceDirect

https://www.sciencedirect.com/science/article/abs/pii/S0065260108603573?via%3Dihub

Time #1

Time #2

Time #3

This is a text block. Click the edit button to change this text.