The Intergovernmental Panel on Climate Change, in its 6h Assessment Report (AR6), warns that the window for “successful climate resilient development” is rapidly closing. Food systems are increasingly stressed and at risk, and new evidence shows multiple breadbasket failure is becoming more likely.

As a result, the World Bank is being called on to reform its practices and priorities to ensure it makes investments that support sustainable, shared prosperity, rather than making it harder to achieve. That is, after all, the founding purpose of the institution. The World Bank is now working out a final Evolution Roadmap, to support this operational upgrade.

In April, citizen climate advisors from 31 countries sent personal letters to World Bank Executive Directors representing their countries or regions. Another round of letters in July aims to contribute to the ongoing global consultation process. The overall list of recommendations can be summarized in the following four governing priorities:

- Invest to support the health of all human beings and all of nature.

- Recognize human rights, and don’t punish the vulnerable.

- Support multilateral cooperative arrangements to accelerate integral human development.

- Include stakeholders in design, delivery, and tracking of development finance.

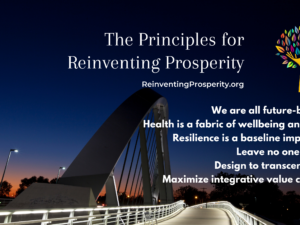

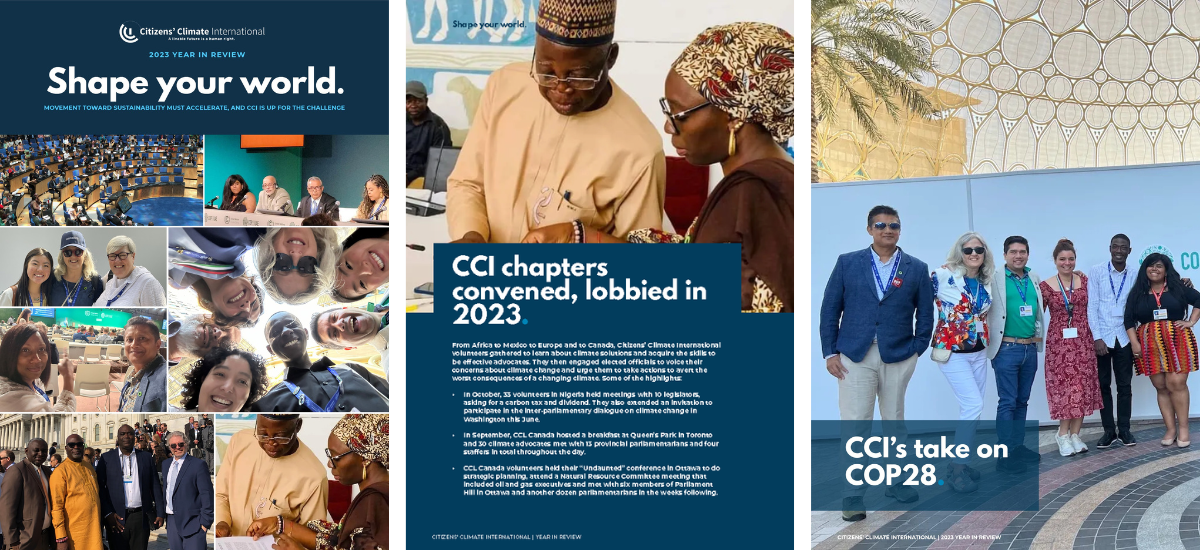

As part of the World Bank Group evolution process Citizens’ Climate International volunteers participated in the regional consultations in Africa in July 2023.

- Kofi Don-Agor and Cedric Dzelu joined the consultation in Accra, Ghana.

- Roland Dedi Olivier joined the consultation in Abidjan, Côte d’Ivoire.

- Kennedy Luther and Faith Khisa joined the consultation in Nairobi, Kenya.

Through the consultation process, they were able to share local, stakeholder perspectives on national and international development finance priorities, and to reiterate principles laid out in stakeholder letters to World Bank Executive Directors, and in the formal briefing note from CCI.

On July 25, Citizens’ Climate International submitted its own substantive contribution to the World Bank evolution process. In it, we call for recognition of the Bridgetown Initiative; grounding of reforms in human rights and gender equality; meaningful, ongoing citizen input; direct delivery of money to households in need; addressing longer term needs of climate-resilient infrastructure; recognizing sovereignty and the rights of Indigenous peoples, including free, prior, and informed consent; guardrails to avoid greenwashing, in line with the United Nations’ Integrity Matters report; and, a coordinated full fair phaseout of fossil fuels, with support for the Fossil Fuel Non-Proliferation Treaty.

To put these asks in context, we note:

“The thread running through all of this is the recognition that value is created far beyond the transactional edge of specific financial arrangements. Failure to value that wider landscape has led to worsening vulnerability, climate disruption, nature loss, and preventable harm.”

We highlight the importance of community participation in decision-making:

“To uplift people and communities, and to deliver not just national development assistance but a measurable and reliable increase in human dignity, safety, and wellbeing, communities should take on a key role in decision-making processes. Our experience is that inclusion enhances ambition, accelerates and improves implementation, while making high standards more actionable, enforceable, transparent, and achievable.”

Ann Grace Akiteng, CCI Teso Group Leader in Northern Uganda, received an award for Outstanding Female in Climate Action at the Grassroots Level. She was honored during the Women in Climate Change Conference (WiCC 2023) at Makerere University Business School in Kampala.

Vulnerability-sensitive debt-relief needs to move much more quickly. More than half of low-income countries are facing debt distress, even as costly climate disasters make every aspect of development more expensive. Sustainable investments need to make energy clean now, and support healthy, sustainable food systems; they also need to prioritize long-term benefits of climate-resilient infrastructure.

Our executive director Joe Robertson said in our press release:

“The future wellbeing and security of all people and nations will require a full, fair phaseout of coal, oil and gas. There can be no more excuses; we must leave polluting business models behind.”

That’s big and complicated work, and it has to happen faster than we ever seriously considered before.

- We need to develop new models for cooperative financing of sustainable activities.

- We need to value innovations that deliver non-financial benefits to the common good, as foundations for all other value creation.

- And, we need to make transformational tools and investment strategies available to marginal and underserved communities, countries, and regions.

CCI suggests multilateral ‘non-market’ cooperative arrangements—as outlined in Article 6.8 of the Paris Agreement—be used to make room for and expand the reach of this inclusive, co-financing standard for climate-resilient development. In the coming months and years, we should expect to see more and more trade deals with these climate-smart characteristics and support for co-investments.

There is no more time to lose. Let’s get to work.

Additional resources

- Evolving World Bank mission & practice to support climate-safe integral human development

- Global network of citizens urges World Bank Group to upgrade for fair and sustainable development

- Non-market approaches as critical drivers of climate ambition

- Transform finance to make human experience climate-safe

- CCI report from June 2023 U.N. Climate negotiations: Only high ambition makes sense now

- Roadmap for scaling impact investment in urban food systems, released by Food Trails Initiative

- Capital to Communities – The 2022 Reinventing Prosperity Report

- International finance reform is gaining momentum

- Resilience Value will change how money works – Towards multidimensional metrics that tell the truth about value-creation

- Five-year sprint to transform food-related finance data