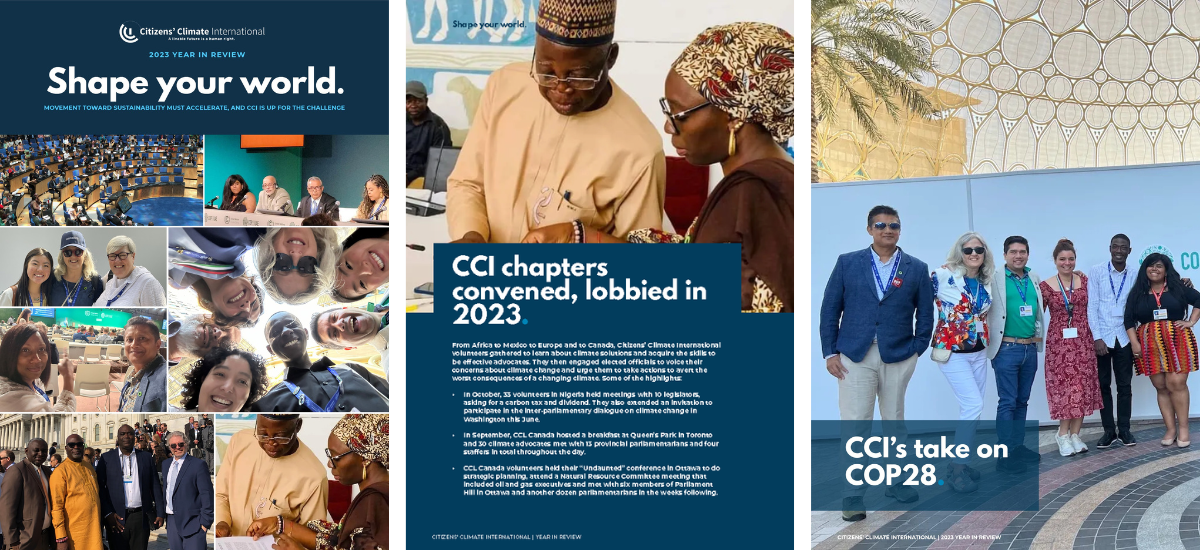

During the opening days of the COP26 United Nations Climate Change negotiations, the Glasgow Financial Alliance for Net Zero (GFANZ) announced it had assembled 450 financial institutions controlling $130 trillion in wealth, committing to align their holdings with a global economy with net zero global heating emissions. The number is astonishing and unprecedented, and so the announcement has been celebrated as a major breakthrough, which it is.

What will the $130 trillion do?

The $130 trillion raises a number of questions, however:

- Will all of the money managed by all of these institutions be aligned with the global net zero goal?

- If so, who will make the changes that allow this to happen?

- Will the $130 trillion be aligned with SBTI—net zero commensurate with 1.5C, including early action sufficient to halve global emissions by 2030?

- Is there an expectation that special facilities will be set up to focus, coordinate, and deliver some of this realigned finance?

- Do all $130 trillion work to clean up scope 3 emissions?

- Will Nationally Determined Contributions (NDCs) for Paris Agreement implementation evolve to capture and catalyze the $130 trillion?

- What new, integratve metrics will develop to provide useful cross-referencing for the accurate tracking of action across the many priorities funded by the $130 trillion?

The biggest question of all: Who can do what with that massive new allocation of capital? Access may turn out to be the trickiest—and most consequential—part of the realignment of one-third of the world’s financial wealth.

To get climate solutions and nature-positive land use to scale, people who have been conventionally excluded from financial services, and who do not in themselves—as individuals, local projects, or community economies—provide significant expanded opportunity for the financial institutions, need to be included. Their wellbeing needs to be an investable priority for financial institutions, large and small, but they cannot afford to give up too much of their own income to financial services.

That means there is a growing need for distributed and networked aggregated systems, a significant change in perspective for markets, and learning to value what has been systematically undervalued. It means valuing the delivery of new financial resources to the financially underserved, as part of a wider effort to build resilience across whole economies, and across financial and monetary systems.

We see in the Glasgow Financial Alliance for Net Zero—and in the provisions of the Glasgow Pact that deal with finance for mitigation, adaptation, loss and damage, capacity building, and arrangements for long-term finance—a call for cross-referencing climate action progress across all sectors and across all regions.

Integrative, evolving metrics are needed.

The Resilience Intel Climate-Smart Finance Initiative, of which CCI is a core partner, proposes Resilience Value as an integrative metric for measuring progress on climate-related financial innovation. Resilience Value needs to:

- Integrate multiple disparate areas of concern;

- Learn, evolve, and adapt to new strategies and information flows;

- Translate overall assessments of value creation and climate progress into directional insights (doing better vs. doing worse / adding value vs. depleting value).

It needs to integrate across:

- Micro-scale operational mitigation of carbon emissions;

- Reduction of Scope 3 / supply chain emissions;

- Overall mitigation of global emissions (OMGE);

- Alignment with science-based targets for 1.5ºC net-zero pathways;

- Micro-scale climate impact management and adaptation benefits;

- Wider (external) adaptation benefits;

- Building vs. depleting the health and resilience of natural systems;

- Progress across the 17 Sustainable Development Goals;

- The inclusive expansion of economic opportunity and the building of human capital (including health and resilience) in low-income, marginal, and front-line communities;

- Strategic innovation value—the degree to which an investment helps to transition the wider economy away from dangerous climate disruption toward livable climate resilience.

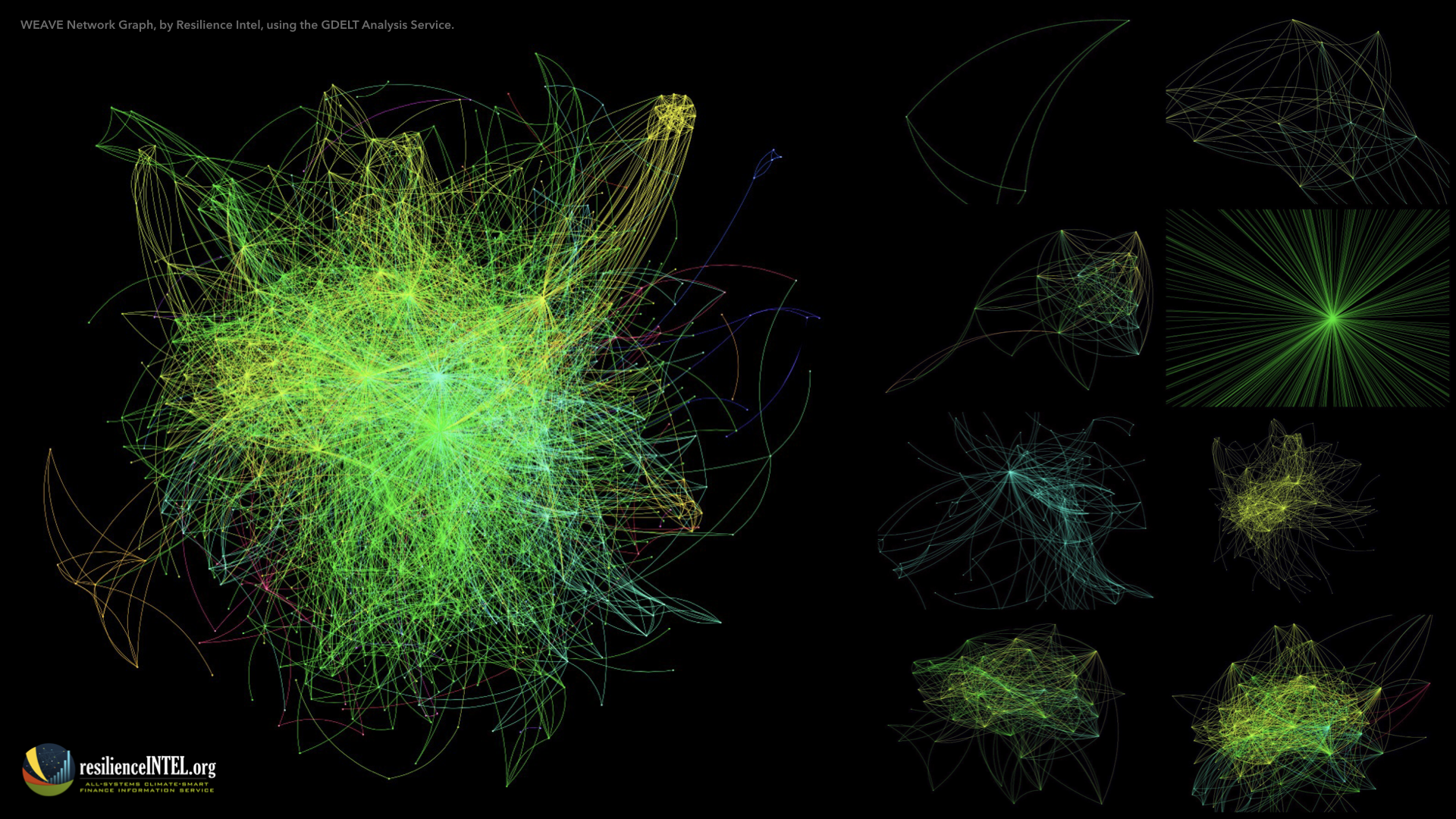

This integrated metric, which might operate differently in different contexts or across different networks, would require complex integration of data systems, reaching and empowering stakeholders who couldn’t afford to finance or fund them. This, then, creates a core logic for financial value assessment that understands cooperative de-risking and cooperative financing as critical strategies for high-value investment at scale.

Before we get to a world where such systems are commonplace and accessible to all, we need both wealth-holders and stakeholders to engineer targeted, partial, first-mover expressions of this thinking.

- Can we invest in food production, while also improving the health of underlying natural systems, reducing harm to marine ecosystems, and providing enhanced food security?

- There is clear resilience value in such a venture. That should be understood, measured, incentivized, and rewarded.

- Similar outcome-specific resilience-building value propositions should become organizing logic for new blended finance initiatives and climate action plans, at local, national, and international levels.

- A very large number of these experiments will be needed to successfully shift $130 trillion onto science-based net-zero pathways, so constructive collaborative innovation efforts, and multi-stakeholder blended finance initiatives need to start coming together quickly.

Financial return for wealth-holders must come to mean success in building value across systems. That must include value-building for the least affluent, for natural systems, and for long-term overall fiscal health and resilience. No nation can afford to lose 25%, 50% or even 100% of GDP, or more, every few years to worsening geophysical shock events. All of us have a stake in each others’ resilience.

The resilience economy is coming.

We need to look for, aim for, organize around, and cooperatively finance resilience-building non-finance outcomes, if we are to live a climate resilient future. This will entail a great deal of learning and experimentation, and we should recognize that and work within that mindset.

All enterprise, development, and financial planning should take stock of the fact that the Glasgow Climate Pact brings 196 nations together in a commitment to:

- Phase down coal use;

- Phase out fossil fuel subsidies;

- Double finance for adaptation;

- Mainstream climate impact, risk, and resilience considerations in public, private, and development finance;

- All while “[recognising] that limiting global warming to 1.5°C by 2100 requires rapid, deep and sustained reductions in global greenhouse gas emissions, including reducing global carbon dioxide emissions by 45% by 2030, relative to the 2010 level, and to net zero around mid-century.”

The Glasgow Pact does not in itself redefine our financial future, but it does set a clear course: Dialogues and institutional arrangements that mobilize major climate-related finance flows must get total commitments to scale in 2022, deliver $100 billion to developing countries, and help bring all nations up to a baseline of operational resilience, so fast-moving climate transformation can happen everywhere.

We need strong, directional carbon pricing in national policy, to support and reward subnational and voluntary commercial carbon pricing efforts, and to consolidate gains for overall mitigation of global emissions. We need finance to reward early actors and open opportunity in underserved communities. And, we need high-level talk about the finance transformation to become real-world action at ground level.

The Glasgow Pact is a call to action, innovation, and inclusion. Science activation and integrative finance will be central to the success of efforts to move from deliberation to delivery.

CCI will be working in 2022 to empower stakeholders and communities to provide structured, credible downscaling of climate science insights for local decision-making, both to support policy and to open new spaces for climate-related investment. We invite everyone to join us.